Using tailored finance

A smarter way to help customers get approved for finance

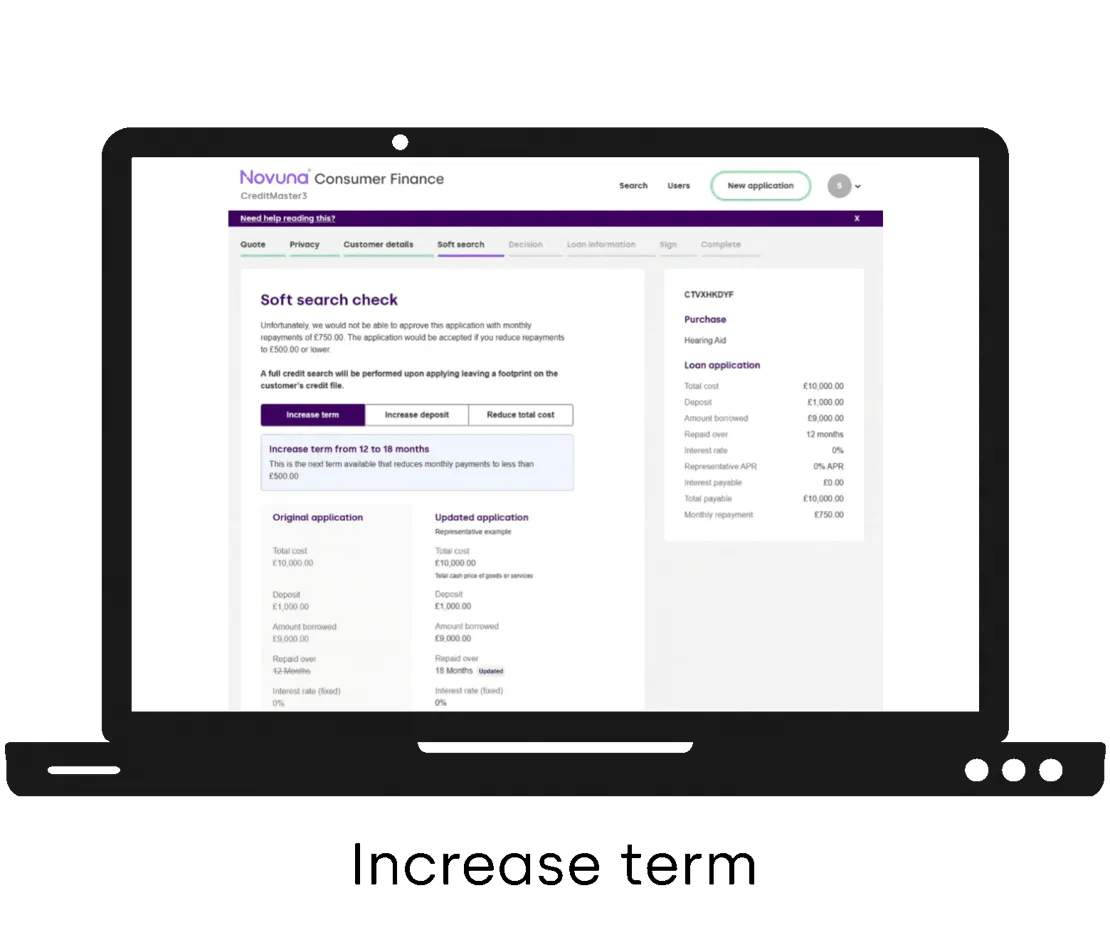

Sometimes, customers applying for finance won’t be approved for their original amount or term, and that can be a tough conversation. But with the tailoring functionality in CreditMaster3, there’s a better way.

Instead of leaving empty-handed, customers may be offered alternative options automatically, such as:

All you need to do is click the tailoring tab on the decision screen. It only takes a moment, but it can make all the difference.

Why use tailoring?

Better for your customers

-

- Gives customers a second chance at approval

- Provides them with alternative terms to suit their circumstances

- Helps maintain trust and confidence in your service

Better for your business

- Reduces lost sales due to declined applications

- Helps you convert more customers into buyers

- Supports stronger overall finance performance

Easier for you

- No need for awkward "you've been declined" moments

- Removes pressure - the system does the heavy lifting

- Lets you offer a solution without extra effort

Quick tips for using tailoring effectively

Need help?

If you have questions about tailoring or how to use it in-store, speak to your team leader or contact your Novuna Relationship Manager for support.