Invoice discounting

-

Cash flow challenge: I want to unlock cash from my invoices without my customers knowing

-

Perfect for: Established B2B businesses with internal credit control teams, looking to improve cash flow while maintaining control of their customer relationships

Novuna helps you compare trusted invoice discounting providers, understand the terms, and apply with confidence.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1977 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Related debt financing options

Pages in this SectionWhat is invoice discounting?

Invoice discounting allows your business to unlock up to 90% of the value of outstanding invoices without your customers knowing you're using a finance facility.

It works best for companies with established credit control processes, as you retain full responsibility for chasing payments and managing the customer relationship. This gives you greater confidentiality, flexibility, and control.

Funds are typically advanced within 24-48 hours of issuing an invoice, making it a powerful tool for managing cash flow, funding growth, or handling large order volumes.

How it works with Novuna Business Cash Flow

- Tell us your funding challenge - complete a short form or call

- We compare providers and recommend a great fit for your situation

- You apply with full support from a cash flow expert

- Access funding fast, often within 24-72 hours

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is invoice discounting right for you?

You want to improve cash flow without waiting for invoices to clear

This is the primary reason businesses use invoice factoring - unlocking working capital tied up in unpaid invoices.

You have strong in-house credit control systems

Since you manage collections, solid internal processes are essential to make invoice discounting work effectively.

You prefer to keep finance arrangements confidential

Invoice discounting is typically confidential, meaning customers aren't aware you're using external financing.

If that sounds like your business, we’ll help you compare lenders and get funded fast.

Novuna can support businesses with a range of late payment challenges

What is your funding challenge?

I want the lender to manage collections on my behalf

I only want to fund selected invoices

I want suppliers to be paid upfront so I can extend my payment terms

I want expert help managing late payments

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

Access a range of short-term funding options including loans, advances, and invoice finance.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises - just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Don’t let unpaid invoices limit your business

Why choose Novuna Business Cash Flow?

Why businesses trust us for invoice discounting

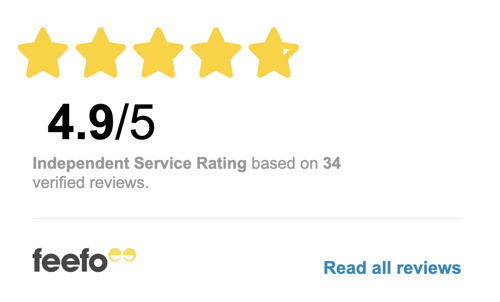

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What invoice discounting looks like in your sector

Get advice tailored to the challenges in your industry

How is invoice discounting different from invoice factoring?

While both release cash tied up in invoices, the key difference lies in control and confidentiality:

- Invoice discounting: You stay in charge of collections, and your customers are unaware of the arrangement.

-

Invoice factoring: The finance company collects payments on your behalf, and customers know they’re dealing with a third party.

Who can use invoice discounting?

Invoice discounting is best suited to established B2B companies that issue invoices with credit terms and manage their own credit control efficiently. It’s particularly beneficial for:

- Businesses with regular monthly invoicing and reliable customers.

-

Firms that want quick access to working capital without external interference.

-

Companies seeking to keep financing arrangements confidential.

What are the main benefits of invoice discounting?

- Confidential funding: Customers continue to pay you directly as the lender remains behind the scenes.

-

Flexible cash flow: You can release capital tied up in unpaid invoices whenever needed.

-

Scalable finance: As your invoiced sales grow, your funding limit automatically increases.

- No new debt: It’s not a traditional loan, you’re simply unlocking money that’s already owed to you.