Project finance

-

Cash flow challenge: I need large scale funding to deliver a major project, but upfront costs and long timelines are putting pressure on cash flow.

-

Perfect for: Developers, investors, and businesses planning infrastructure, energy, or commercial projects that require staged, high value funding.

Project finance helps businesses secure the capital needed for large and complex projects, without draining day-to-day cash flow.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1982 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Explore seasonal funding options

Pages in this SectionWhat is project finance?

Project finance is long-term funding used to support large scale developments or infrastructure projects. Loans are usually structured around the project itself, with repayments tied to the revenue it generates once completed.

It helps cover major costs such as land, construction, technology, equipment, and professional fees ensuring the project progresses without putting your company’s working capital at risk.

How it works with Novuna Business Cash Flow

-

Tell us about your project and funding requirements

-

We compare providers and recommend a great deal for your situation

-

You apply with full support from a project finance expert

-

Access funding quickly, with terms that match your business cycle

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is project finance right for you?

You’re funding a large scale infrastructure, energy, or commercial project

Project finance is designed for high-value, long-term developments requiring significant capital.

You need long-term, staged funding aligned to project milestones

Funds are drawn down in phases, matching construction or delivery progress.

You want repayments linked to project revenues rather than upfront debt

Repayments are structured around the cash flow the project generates, not existing balance sheet strength.

If that sounds like your business, we’ll help you compare providers and secure the right deal.

Novuna can support a range of project and business finance needs

I need short-term support while waiting for long-term funding

I offer credit terms but need to protect my cash flow

I want to fund expansion alongside a major project

I’m looking for tailored advice for my sector

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

We will provide the correct type of project finance options for your funding type.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Why choose Novuna Business Cash Flow?

Why developers and businesses trust us for project finance

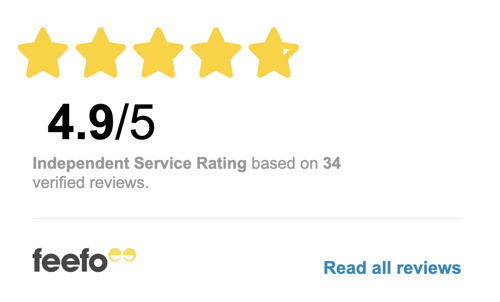

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What project finance looks like in your sector

How does project finance work in the UK?

In the UK, project finance often involves the creation of a special purpose vehicle (SPV) is a separate legal entity that owns and operates the project. Investors and lenders provide funds, and repayments are made from the project’s future revenues, with limited recourse to the project sponsors.

What types of projects use project finance?

- Energy and renewables (wind, solar, biomass)

-

Transport infrastructure (roads, rail, airports)

-

Utilities and social infrastructure (water, hospitals, housing)

-

Industrial or export-led developments supported by UK Export Finance (UKEF)

What are the benefits of project finance?

- Off-balance sheet funding, reducing corporate debt exposure

-

Risk sharing among lenders, sponsors, and contractors

-

Predictable repayment structure tied to project revenues

-

Access to large-scale capital for infrastructure development