Debt recovery

-

Cash flow challenge: I’ve got unpaid invoices and need help recovering what I’m owed.

-

Perfect for: SMEs that want to recover overdue payments without writing off debt or damaging customer relationships.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1979 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Our late payment solutions

Pages in this SectionWhat is debt recovery?

Debt recovery services help businesses recover money they’re owed from unpaid invoices to long outstanding debts.

They use structured, professional methods to encourage payment while complying with legal and ethical standards. Unlike informal chasing, recovery partners can escalate the process where necessary but often focus on preserving relationships wherever possible.

How it works with Novuna Business Cash Flow

-

Share your challenge - from a single unpaid invoice to multiple aged debts

-

We compare providers and recommend a great fit for your situation

-

You engage the right partner with our support

-

Recover what you’re owed without unnecessary escalation

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is debt recovery right for you?

You might benefit from professional debt recovery support if

You’ve exhausted internal chasing but still haven’t been paid

Debt recovery services step in when standard credit control efforts have failed.

Your business is at risk because of unpaid invoices

Helps recover critical funds to protect cash flow and business stability.

You’re unsure how to pursue legal or formal recovery

Provides expert guidance and action on the most effective route to secure payment.

If that sounds like your business, we’ll help you take action with confidence.

Novuna can support businesses with a range of late payment challenges

I want to unlock cash while I wait for invoices to be paid

I want to prevent invoices going overdue in the first place

I want tailored late payment advice for my industry

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

including stock finance, trade credit or blended options.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Don’t let overdue invoices drain your team’s time

Why choose Novuna Business Cash Flow?

Why businesses trust us for support with late payments

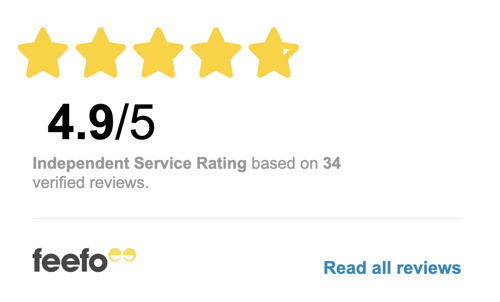

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What late payment support looks like for your sector

Get insight and support tailored to your sector

What types of debts can be recovered?

Unpaid invoices, aged debts, and even historic write-offs may be recoverable. We’ll help assess your options.

What are my options if I’m owed money?

- Try mediation before legal action

-

Send a formal demand for payment

-

File a small claim in court

- Recover money through a County Court Judgment or enforcement order

What’s the difference between debt recovery and debt collection?

Debt recovery often refers to business-to-business invoice recovery, while debt collection is a broader term that includes consumer debts like credit cards, loans, or utilities.