Development finance

-

Cash flow challenge: I need funding to kickstart or complete a property development project.

-

Perfect for: Property developers and business owners funding new builds, refurbishments or commercial conversions.

Development finance helps you access the capital you need for your next property project fast.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1982 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Our debt financing options

Pages in this SectionWhat is development finance?

Development finance is short to medium-term funding that supports the cost of building, refurbishing, or converting property for residential or commercial use.

It can help cover land purchase, build costs, fees, or even marketing and funds are typically released in stages as work progresses.

Whether you’re a developer, investor or business owner, this type of funding keeps your project moving without draining cash flow. Development finance in essence is a specialist form of business loan for property developments and projects.

How it works with Novuna Business Cash Flow

- Tell us your funding challenge - complete a short form or call

- We compare providers and recommend a great fit for your situation

- You apply with full support from a cash flow expert

- Access funding fast often within 24-72 hours

Is development finance right for you?

You’re planning a ground-up development or conversion

Development finance is tailored for large scale property projects like new builds or major renovations.

You need staged funding to match your project timeline

Funds are released in phases, aligned with build progress, helping you manage costs and cash flow efficiently.

You’re building to sell or let for residential or commercial

Whether your goal is profit or rental income, development finance supports both residential and commercial strategies.

If that sounds like your business, we’ll help you compare providers and get funded fast.

Novuna can support businesses with a range of funding challenges

I want to release cash from my unpaid invoices

I’m investing in equipment or vehicles for a construction project

I want to fund the growth of my business alongside property expansion

I’m looking for tailored advice for my sector

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

Access a range of short-term funding options including loans, advances, and invoice finance.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Don’t let cash flow slow down your project

Why choose Novuna Business Cash Flow?

Why property developers and business owners trust us

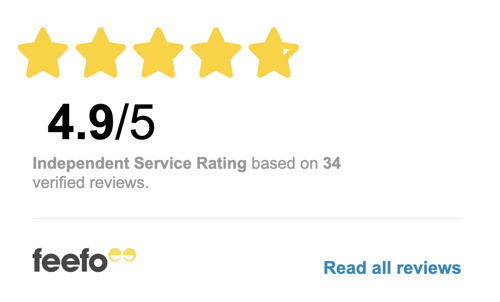

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What funding looks like in your sector

Get advice tailored to property and construction challenges

How much can I borrow with development finance?

Most UK lenders offer up to 70% of the Gross Development Value (GDV) or around 90% of total development costs. The exact amount depends on your experience, project type, and exit strategy.

What are the typical rates for development finance?

Interest rates generally range from 4.5% to 14% per year, depending on factors like project size, loan-to-GDV ratio, and developer experience. Arrangement and exit fees may also apply, typically around 1-2% of the loan value.

Who is eligible for development finance?

Development finance is suitable for experienced property developers, investors, or builders with approved planning permission and a clear exit strategy. Some lenders also support first time developers if the project has strong fundamentals and professional support in place.

Can I get development finance if I’ve never developed property before?

Yes but lenders will assess your experience and team. If you’re a first time developer, we’ll help you prepare the right documents to improve your chances.