Purchase order finance

-

Cash flow challenge: I’ve secured a customer order but need help funding suppliers to fulfil it.

-

Perfect for: Manufacturers, wholesalers, and importers needing to pay suppliers before receiving customer payment

Novuna helps growing businesses secure the funding they need to fulfil large orders. Whether that means paying overseas suppliers, managing upfront production costs, or covering freight and duties.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1982 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Our supply chain finance options

Pages in this SectionWhat is purchase order finance?

Purchase order finance helps you accept and fulfil large customer orders even if you don’t have the cash available to fund suppliers upfront.

Instead of turning away a valuable opportunity, this short-term funding solution allows you to pay manufacturers, wholesalers, or freight providers based on the strength of your customer’s order.

It’s commonly used by businesses that trade goods, handle physical inventory, or buy in bulk giving you the power to fulfil contracts and grow without tying up working capital.

What are the differences types of purchase orders?

1. Standard purchase order

This is the most common type of order and is used for a single order where all the information is known and can be included on the purchase order form.

The information included will be the relevant addresses, the item(s) to be purchased, the quantity needed, the price and the date to be delivered.

2. Blanket purchase order

A blanket purchase order form is used when a customer places orders for goods or services from its supplier that will be repeated, be delivered on different dates over a specific period and will require multiple payments. It is often used for goods that are expendable as the customer can’t hold all the stock at the same time and may involve differing amounts and quantities.

3. Planned purchase order

A planned purchase order is a commitment from the buyer to purchase goods or services from a single supplier over the long term. The buyer is legally bound to commit to the price and the quantity of the item but may not know in advance what the delivery dates will be.

The information included in a planned purchase order will be information on the goods or services required with quantities, costs and possible delivery dates. Once the specific dates for the items to be delivered are known the buyer will submit a release form to the supplier.

4. Contract purchase order

A contract purchase order is for businesses that have not yet indicated to the supplier what goods and services they will be purchasing but want to create a contract purchase agreement to determine what the specific terms will be. This could include information on payment and delivery and forms the basis for a future commercial relationship.

How it works with Novuna Business Cash Flow

-

Tell us about the order you need to fulfil

-

We compare providers and recommend a great fit for your situation

-

You apply - with full support from a cash flow expert

-

Once approved, funds are paid directly to your supplier

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is purchase order finance right for you?

You’ve secured a large customer order you don’t want to turn away

Provides the funding to fulfil big orders without straining cash flow.

You need to pay suppliers before your customer pays you

Bridges the gap between supplier costs and customer payment.

You want short-term funding based on confirmed orders

Unlocks finance quickly, using the security of verified purchase orders.

If that sounds like your business, we’ll help you compare providers and unlock the right facility.

Novuna can support businesses with a range of supply chain finance challenges

For supply chain and trade related funding:

I want to fund supplier purchases before customer payment

I want extended credit terms to manage stock purchases

I need help paying overseas suppliers and managing duties

I want to release cash tied up in inventory

I want to support my suppliers while extending payment terms

I want funding advice tailored to my sector

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

Access a range of short-term funding options including loans, advances, and invoice finance.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Don’t let cash flow hold back your next big order

Why choose Novuna Business Cash Flow?

Why businesses trust us for purchase order finance

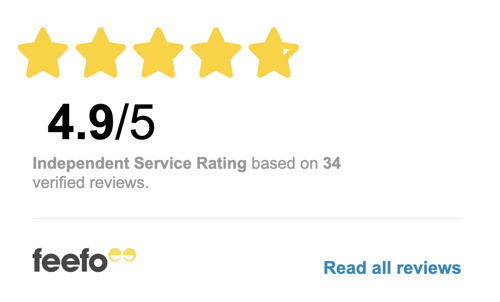

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

More advice for importers and exporters

Get support based on how and where you trade

How is purchase order finance different from invoice finance?

Purchase order finance helps you fund supplier costs before the order is fulfilled. Invoice finance releases cash after the sale has been invoiced.

Do I need a confirmed customer order to apply?

Yes as most providers will need a verified purchase order and supplier quote to approve funding.

How does purchase order finance work?

A lender pays your supplier directly to produce or deliver goods. Once your customer pays the invoice, the lender takes their fee and transfers the remaining balance to you.

What are the benefits of purchase order finance?

- Accept larger orders without cash flow strain

-

Pay suppliers on time and build trust

-

Grow sales without needing extra capital

- Bridge funding gaps between order and payment