Reverse factoring

-

Cash flow challenge: I want to support my suppliers while extending payment terms.

-

Perfect for: Buyers who want to optimise working capital while keeping suppliers paid on time

Novuna helps you compare reverse factoring providers and implement solutions that support your cash flow and your supplier base.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1977 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Related funding options

Pages in this SectionWhat is reverse factoring?

Reverse factoring (also known as supply chain finance or supplier finance) allows businesses to work with a third-party funder to pay their suppliers early, while extending their own payment terms.

It’s ideal for companies that want to strengthen supply chain relationships without compromising their own working capital position.

The supplier gets paid promptly by the finance provider, and the buyer repays the lender on agreed terms giving both parties greater stability and flexibility.

How it works with Novuna Business Cash Flow

- Tell us your supplier payment goals - complete a short form or call

- We compare providers and recommend a great deal for your situation

- You apply with expert support from our team

- Suppliers are paid quickly, and you benefit from longer terms

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is reverse factoring right for you?

You want to support suppliers with early payments

Reverse factoring allows your suppliers to get paid faster, improving their cash flow and stability.

You’d benefit from extending your own payment terms

You can delay outflows while suppliers still get paid promptly, helping you manage working capital more effectively.

You’re looking for funding without taking on traditional debt

Reverse factoring lets you unlock supply chain finance without adding liabilities to your balance sheet.

If that sounds like your business, we’ll help you explore your options and get set up with the right solution.

Novuna can support businesses with a range of funding challenges

I’ve won a large order but need help with materials

I need flexible credit terms with my suppliers

I want funding to stock up before peak demand

I want a facility that supports international trade

How we help

How Novuna helps businesses access funding fast

Tell us what you need

start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Understand how reverse factoring works

We guide you through the mechanics from setting up your facility to onboarding suppliers.

Apply with expert support

You’ll get real human help with your application and onboarding process.

Keep your suppliers happy

Use reverse factoring to build trust and ensure your supply chain stays strong.

Improve your working capital

Extend your own payment terms without hurting supplier cash flow.

Why take action now

Protect your cash flow and your supply chain

Why choose Novuna Business Cash Flow?

Why businesses trust us for reverse factoring:

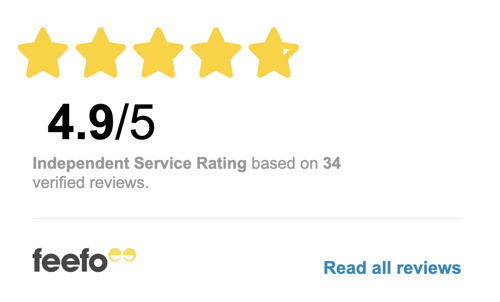

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What funding looks like in your sector

Get advice tailored to the challenges in your industry

How is reverse factoring different from traditional factoring?

Traditional factoring is supplier-led where the supplier sells invoices to a finance company for quick payment. Reverse factoring is buyer-led where the buyer arranges for suppliers to be paid early by the financier. The key difference lies in who initiates and controls the funding.

Who uses reverse factoring?

It’s typically used by large businesses and corporate buyers who want to support their supply chain partners, though mid-sized UK firms are also adopting it to strengthen supplier relationships and ensure reliability during growth or high-demand periods.

What are the benefits of reverse factoring?

-

Suppliers get faster access to cash at competitive rates.

-

Buyers can extend payment terms without damaging supplier relationships.

-

Both parties benefit from improved working capital and reduced supply-chain risk.

How quickly can reverse factoring be set up?

Once approved, suppliers can start receiving early payments within days. We’ll help guide the onboarding process for all parties.