Vendor finance

-

Cash flow challenge: I want to help customers purchase equipment or assets by offering flexible finance options.

-

Perfect for: Vendors, manufacturers, and suppliers looking to boost sales, retain customers, and offer in-house or partnered finance solutions.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1977 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Related asset finance options

Pages in this SectionWhat is vendor finance?

Vendor finance (also known as seller finance) is when a business selling goods or services provides finance directly to its customers, helping them purchase assets without needing a traditional bank loan. The buyer repays the vendor over an agreed period, often with interest.

This type of finance is popular in sectors like equipment supply, manufacturing, and property, where vendors want to make purchasing easier and build stronger long-term customer relationships.

How vendor finance works

In a vendor finance arrangement, the seller provides or arranges funding so the customer can complete their purchase. The repayment is made in instalments, and the asset being financed can act as security.

Typical structure:

-

Seller provides funding: The vendor acts as or partners with a finance provider.

-

Agreed terms: Both parties set the interest rate, repayment period, and collateral.

-

Customer makes regular payments: Usually monthly or quarterly, over an agreed timeframe.

-

Improved sales outcomes: Customers can buy immediately without upfront capital.

Benefits of vendor finance

For vendors:

- Boost sales by removing affordability barriers

-

Strengthen customer relationships through flexible payment options

-

Compete effectively in price sensitive markets

-

Unlock repeat business and long-term loyalty

For customers:

- Access equipment or assets without large upfront costs

-

Enjoy faster approval and simplified credit checks

-

Maintain working capital for other business needs

-

Build credit while growing their business

Common vendor finance uses

For vendors:

- Equipment and machinery sales: ideal for construction, manufacturing, or logistics suppliers.

-

Vehicle finance: for dealerships offering customer or business finance.

-

Technology and IT equipment: for tech vendors supporting long-term client contracts.

-

Business acquisitions: where the seller helps the buyer purchase part or all of a company.

These arrangements often complement other forms of funding such as secured business loans or asset finance solutions.

How it works with Novuna Business Cash flow

-

Tell us what you’re looking to fund

-

We compare providers and recommend a great deal for your situation

-

You apply with support from a finance expert

-

Get a fast decision and receive funding quickly

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is vendor finance right for you?

You want to help customers buy from you with flexible payment options

Vendor finance allows you to offer funding at the point of sale, helping customers purchase your products or services without upfront cost.

You’re looking to increase sales and attract more buyers

Ideal for vendors who want to remove affordability barriers making it easier for clients to commit and complete purchases.

You want to strengthen customer relationships and loyalty

By providing finance directly or through a partner, you position your business as a trusted, long-term growth partner for your clients.

If that sounds like your situation, we’ll help you compare lenders and get funded fast.

Novuna can support a range of equipment funding needs

I need to fund a fleet or commercial vehicles

I want to own the asset outright at the end

I want flexible equipment use without ownership

I want lower monthly costs with optional upgrades

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

Access a range of short-term funding options including loans, advances, and invoice finance.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Why choose Novuna Business Cash Flow?

Why property developers and business owners trust us

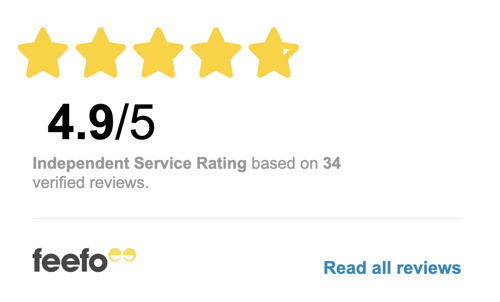

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What asset finance looks like in your sector

Get advice tailored to the assets your business needs

Who can offer vendor finance?

Any business selling high-value goods or services such as equipment, vehicles, or technology can offer vendor finance directly or through a partner like Novuna.

Is vendor finance the same as a business loan?

Not quite. A business loan is taken by the buyer from a lender. Vendor finance, however, is funding offered by the seller, often supported by a finance partner.

What are the risks of vendor finance?

The main risk lies in buyer default. Partnering with a finance provider like Novuna mitigates this risk by handling the lending and repayment process.

How can vendor finance help my business grow?

By offering finance to your customers, you can boost sales, reach new clients, and improve your competitive edge especially in markets where upfront payments are a barrier.