2024: Returning growth, falling inflation and rate cuts

We've teamed up with Pantheon Macroeconomics, a premier provider of unbiased, independent macroeconomic research to bring you a summary of the UK economic outlook.

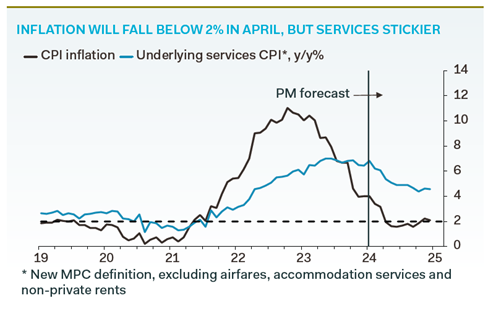

The UK has already returned to solid growth after last year’s minor recession. The Monetary Policy Committee (MPC) is on course to cut interest rates 0.25pp in June and three times in total this year...as headline Consumer Price Index (CPI) inflation falls below 2% in April, but strong services inflation keeps the MPC on alert.

The economy is already putting last year’s minor recession in the rear-view mirror.

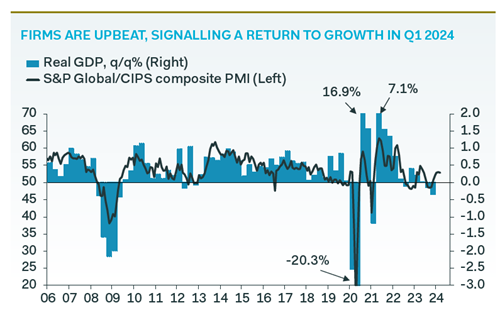

Gross Domestic Product (GDP) rose 0.2% month-to-month in January and firms are upbeat. S&P Global/CIPS’ Purchasing Managers Index, which gives an early growth signal, sits close to a nine-month high. What’s more, in March firms’ expectations for growth over the next 12 months, also reported in the PMI, were at their second-strongest since February 2022. We think Gross Domestic Product is on track to gain 0.3% quarter-to-quarter in Q1.

Falling gas prices provide the tailwind propelling this economic turnaround.

They have reversed the vast majority of their surge in 2022 after Russia invaded Ukraine. That surge took inflation into double digits, cutting households’ real disposable income. Falling gas prices are now cutting inflation, so real wages have returned to growth. We think household real disposable income will rise 2.2% year-over-year in 2024, the strongest since 2015, taking real consumer spending to a 2.0% year-over-year gain in Q4 2024, and GDP t o 1.2% growth.

The chart above shows we expect headline CPI inflation to dip below 2% in April and stay there until November.

Falling utility prices as well as easing goods and food inflation drag inflation down. Meanwhile, the labour market remains tight but continues to loosen gradually, with year-over-year growth in wages excluding bonuses falling to a 19-month low of 5.7% in January. That is still far too high to be consistent with inflation staying at the 2% target, but wage growth will keep slowing. Services inflation has been stickier than headline CPI inflation, as our chart above shows, because those strong wage gains continue to pass through to prices. We expect services inflation to slow gradually but remain elevated, even by the end of the year.

The MPC continues to shift its guidance closer to supporting rate cuts. We think it will lower interest rates by 0.25pp in June, then again in September and December. Sticky services inflation is keeping the MPC cautious, however, so the risks are biased to a later first cut, and fewer cuts this year.