Sectors in Focus

Novuna’s Business Barometer recorded progress across 13 industry sectors, exploring small business growth ambitions, opportunities, and threats in each.

This chapter examines four sectors—Manufacturing, Construction, Agriculture, Hospitality & Leisure—from the Business Barometer’s 2014 launch to the present.

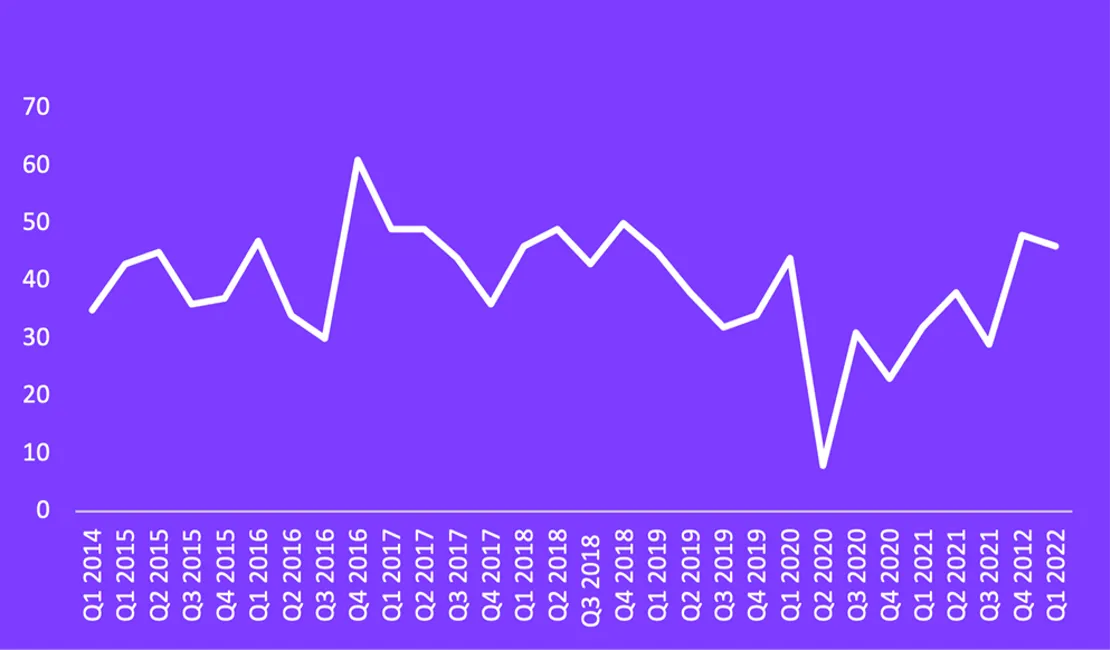

Manufacturing

According to the United Nations Conference on Trade and Development, the UK is the ninth largest manufacturer in the world with an output of £192 billion, employs 2.7 million people, and accounts for 45% of total exports. Even allowing for the 1970s decline, the manufacturing sector has increased by 1.4% every year since 1948. 2016 was the year of the referendum. While initial uncertainty meant confidence dropped in the quarter immediately after the referendum result, the recovery into Q4 of that year was one of the sharpest on record.

Spirits were high as the manufacturing sector emerged as the most likely to see opportunities from leaving the EU: almost three-quarters (70%) cited reasons to be optimistic about Brexit, including the weak pound and possible reductions in red tape. The highest growth forecast since the Business Barometer began was recorded in Q1 2016 when almost half (47%) of the small business owners in manufacturing were planning on growing the business over the next quarter, higher than the national average of 39%.

This was the sector most likely to see opportunities elsewhere. Nearly a third (32%) of the sector were planning to expand into overseas markets, such as North America, to achieve growth over the next 12 months. Confidence had been buoyed by the prospects of cheaper exports and, whilst trying to keep fixed costs down, manufacturing enterprises were investing in new equipment and expanding the workforce. Before the General Election in June, the sector was the keenest to see strong Brexit leadership from the Government that they believed would negotiate favourable trade deals beyond the EU. Manufacturing emerged as the least likely sector to want a reversal on the decision to leave the EU—26%, compared to the national average of 31%. However, uncertainty before and immediately after the election precipitated a drop in confidence.

Throughout the election period, optimism declined for the manufacturing sector, and the relatively buoyant business mood fell sharply over the course of a year. The reasons to be optimistic at the beginning of the year were slowly muted, with increased concerns over a weak pound, less possibility of there being less red tape, and fewer enterprises thinking Brexit would result in the UK Government supporting UK businesses more.

In 2018, the manufacturing sector shifted its growth agenda from Brexit to finance. Whilst 81% were looking to grow in Q1 2018 (by keeping fixed costs down, improving cash flow and getting paid on time), 71% were worrying about the future of their business. By the second quarter more than half of manufacturing enterprises (52%) said they needed access to finance to grow and support their business. According to our findings, Manufacturing was one of the sectors most affected by late payments, and in July keeping fixed costs down became the number one priority. Reflecting on the past twelve months, almost half (48%) of the manufacturing sector were uncertain about the future of the business and were the most likely to cite Brexit as having one of the biggest negative impacts on expansion during 2018.

Opinions about Brexit started to shift again in Q1 2019 when 55% of manufacturers could perceive opportunities, rising to 64% in 12 months. However, growth prospects for the small business community plummeted to an all-time low in Q2 2020 as the first effects of Covid-19 were felt across the industry. The proportion anticipating a contraction in this quarter (66%) was higher than the proportion of businesses anticipating growth at any other time on record. Just 13% of decision makers were optimistic about the future—falling to 9% of those in manufacturing.

Due to repeated restrictions throughout the year, some companies had to work from home, many had to furlough staff, and others closed doors for the foreseeable future (some permanently). With contraction rising to 66%, manufacturing small businesses were not planning for growth but survival. Their strategies included diversifying products and services, and allocating resources to make the most of opportunities, even as they reduced fixed costs.

Meanwhile, Brexit worries dropped from 44% in Q4 2020 to 30% at the beginning of 2021— with only 26% of manufacturing businesses citing Brexit as preventing their expansion. By the end of the year, manufacturing emerged as the sector most likely to be looking to develop partnerships with non-EU-based partners in the new year, looking to expand into the EU and the Far East in 2021.

Whilst some industries are still feeling the ongoing effects of the Omicron variant, the Manufacturing sector has returned to pre-pandemic levels with almost half of small companies (48%) in the sector predicting growth ahead of the new year.

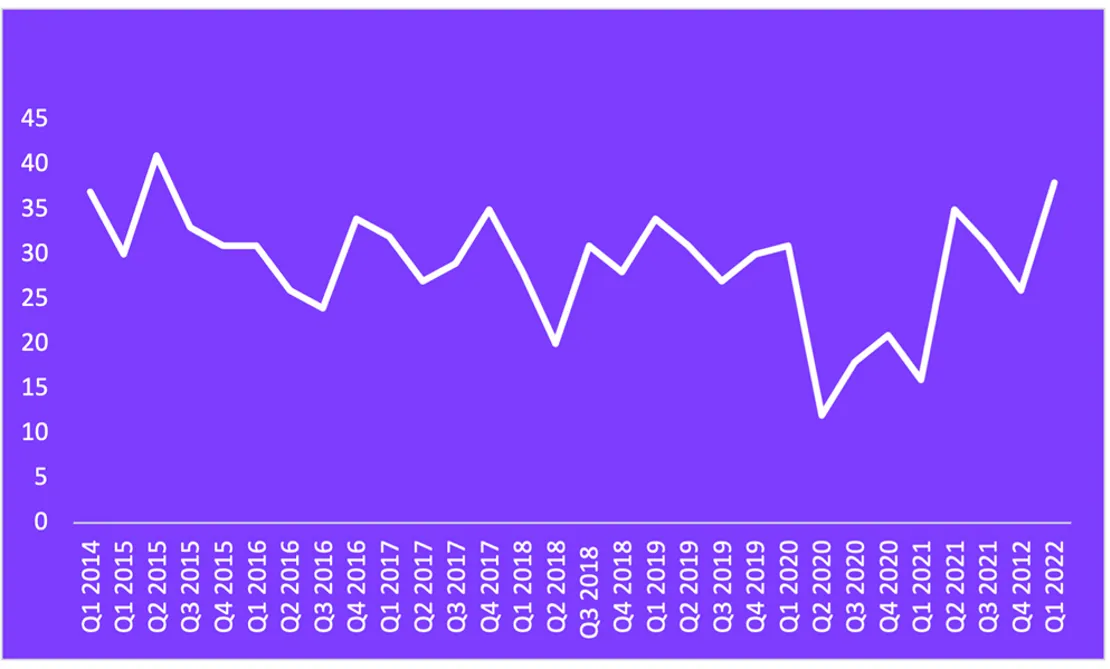

Construction

Since the Barometer began at the end of 2014, growth has remained steady within the construction sector despite crises including the collapse of Carillion, fluctuating exchange rates, a referendum, a general election, extreme weather, and the loss of staff.

2018 was a worrying year for the construction industry—more than one in five companies (22%) said their biggest concern was economic volatility. The fall of Carillion at the beginning of the year and spells of bad weather affected small business confidence in the second half of 2018. Further, December 2018 saw the construction industry hit a three-month low, amid Brexit concerns and a declining demand for commercial projects.

10 biggest issues for future growth from 2018

By the end of 2019, half of the businesses operating in construction (50%) admitted they would face challenges if they were unable to secure finance. Their biggest challenge would be hiring new people (27%); 22% said they would struggle to compete with larger companies; and 21% would not be able to afford new vehicles.

Covid-19 hit the construction sector hard in Q2 2020. Three in five small construction businesses (65%) predicted they would be scaling down the company’s operations with a strong possibility of closures.

Just 16% of small businesses decision makers in construction headed into 2021 with ambitions for growth—some of the lowest results over the Business Barometer’s seven years of tracking. Nevertheless, this dip in confidence didn’t stop construction companies from trying to grow.

10 ways small construction businesses were looking to grow at the beginning of 2021

Despite attempts to remain positive in the face of supply chain, finances and staffing issues, the sector was one of four to harbour concerns about the long-term impact of Covid-19 on business growth – along with Hospitality & Leisure, Manufacturing, and Retail.

The year 2021 has ended, and % of small construction businesses are optimistic about 2022. Plans are underway to make the small businesses in the sector stronger with better financial management. Almost two in five small businesses in construction (37%) are concentrating on building up the company’s financial reserves; some are looking to increase new business sales (36%); whilst others will be attempting to reduce fixed costs (24%).

The findings further reveal that businesses will be planning ahead with business budgeting, will be adapting financial forecasts to allow for seasonal highs and lows, and will also be looking for professional help and advice. After a challenging year, the results indicate cautiousness amongst construction small businesses as owners try to focus on safeguarding for the year ahead—showing that they have learnt from past challenges.

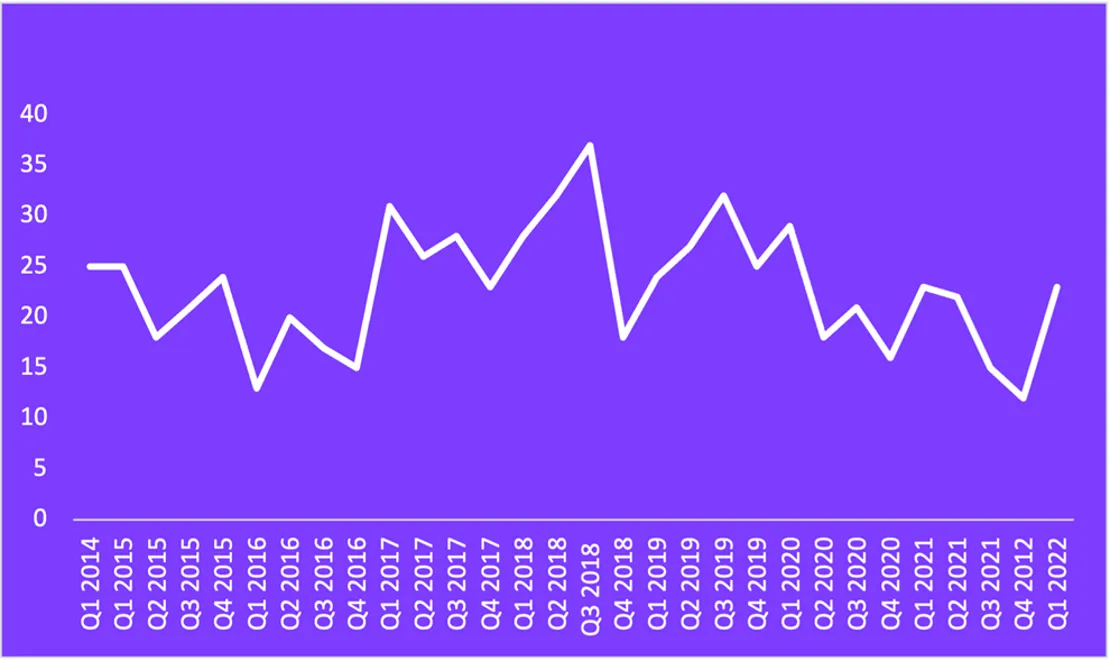

Agriculture

Farming is the bedrock of the UK economy; the sector employs more than 4 million people and contributes over £120 billion to the country’s economy. It secures a food system within our shores, feeding the nation through good and challenging times, and delivering a wide range of environmental and rural community benefits enjoyed far beyond the gates of a farm.

At the beginning of 2016, small agricultural businesses were filled with uncertainty arising from the EU referendum; only 13% were optimistic about future growth. The industry was central to the debate, and it was reported that farmers were divided in their views: some could see the benefits; others felt being separated from Europe would create trade difficulties.

However, by the beginning of 2017, more than half of small businesses in the Agricultural sector (52%) were optimistic about the opportunities arising from leaving the EU—despite being faced with subsidiary shortages and a loss of labour. Remaining positive about the divorce from Europe, nearly a third of small agricultural enterprises (31%) anticipated less red tape.

One in four (25%) recognized opportunities in UK consumers ‘buying British’ and 24% reported the weak pound at the time as good news for exports. Small businesses in the sector were the most likely to see an opportunity in being able to develop business partnerships with non-EU-based entities (14%). Almost half of agricultural small businesses (48%) were keen to see a government commit to negotiating favourable trade deals beyond the EU— far higher than the 24% average across all sectors.

In 2018, the Barometer recorded the highest growth since 2014. Almost a third of small business decision-makers (32%) in the sector were confident of future growth. Whilst optimism gradually dipped again during the year—small agricultural businesses were twice as likely as the national average to say that cash flow was holding their business back (28% vs 14%)—it was back to 32% in Q3 2019. Of the 14 sectors surveyed at that time, small agricultural businesses were the most likely to intend to invest in new equipment and reassess the company’s financial commitments, whilst keeping fixed costs down. This was the last time Novuna’s Business Barometer saw small agricultural businesses, out of all the sectors surveyed, as the most positive about growth.

In Q2 2021, the sector was battling Covid-19, lockdowns, major supply chain shortages, lack of staff due to sickness, and financial instability. The sector experienced its most extreme contraction on record with businesses struggling to survive and some risking closure (37%). Agricultural was the only sector where growth forecasts failed to rise, with 76% saying there were barriers to the businesses’ growth, reducing to 74% by Q4 2021.

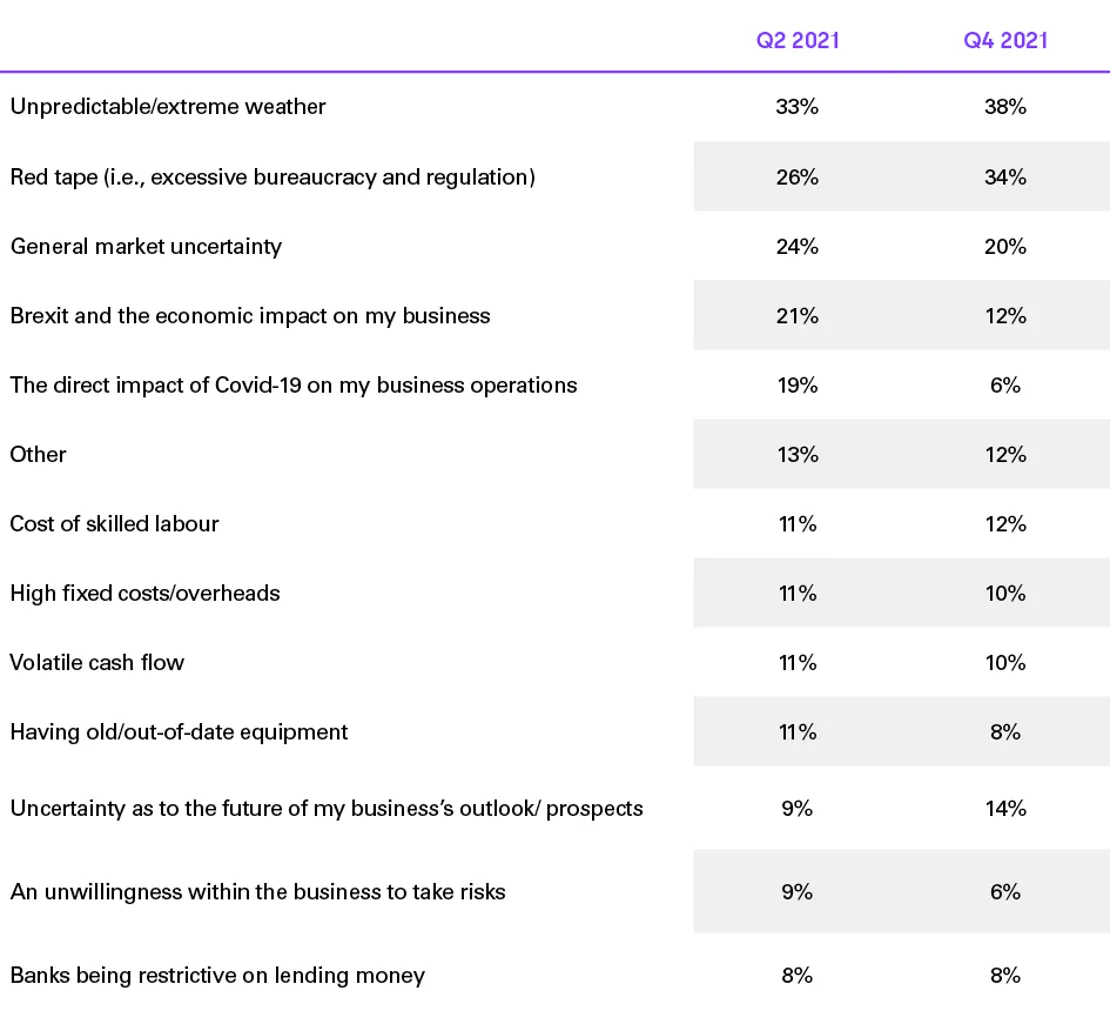

The last quarter of 2021 saw the Business Barometer track its lowest growth for small businesses in Agriculture (12%). Findings revealed that concerns about the future had risen over a 6-month period. Whilst worries about Brexit and Covid-19 faded, concerns about the cost of skilled labour, extreme weather, and excessive red tape intensified. A mammoth task lies ahead in securing a sustainable economic recovery and, as they get back to full strength, small businesses are up against supply chain disruption, spiralling costs, and skills shortages.

Top 15 barriers to growth for small businesses in the Agricultural sector (Q2 2021 vs Q4 2021)

Hospitality & Leisure

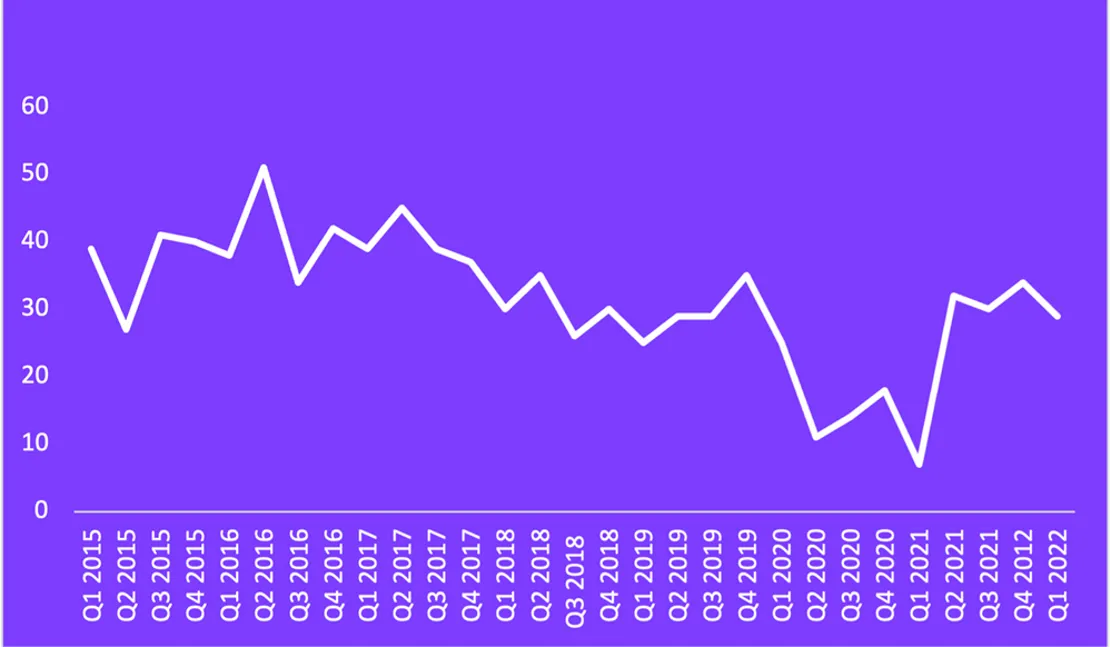

The Business Barometer shows the Hospitality & Leisure sector businesses were relatively bullish about the future at the beginning of 2016. Q2 saw the sector hit its highest growth on record with more than half of small businesses (51%) predicting significant expansion or modest growth in the next few months. This optimism came despite fears that the EU referendum could possibly hinder future growth.

The research suggests that small business outlook in this sector was largely unaffected by the pros and cons of leaving the EU as well as the fluctuating oil prices at the time. Small business confidence seemed to be based more on the strength of their own plans and immediate supply chain relationships. At the beginning of 2016, Hospitality & Leisure small businesses were looking to keep fixed costs down, improve the company’s cash flow, and invest in new equipment.

10 areas for achieving growth at the start of 2016

After a slight peak in growth in Q2 2017, the findings show us that optimism waned until Q1 2020 when the Hospitality & Leisure sector immediately felt the effects of Covid-19. The sector hit its highest recorded contraction over seven years of tracking—53% of small businesses within the sector were scaling down and struggling to survive. Hospitality & Leisure was among the most likely sectors, along with Retail, Construction, and Manufacturing, to be concerned about Covid-19’s long-term economic impact.

Although there were signs that growth forecasts started to recover for troubled sectors (Hospitality & Leisure, Retail, and Construction), confidence was still fragile—with many owners acutely aware of how further Covid-19 developments could destabilise their businesses.

Areas small businesses would struggle to grow without more finance

Even with the various measures taken by government to support hospitality businesses, such as the ‘eat out to help out scheme,’ the sector was hit hard financially. By Q2 2020, Hospitality & Leisure businesses were those most focused on building up the company’s financial reserves (30%) as a means of survival. The sector admitted that they needed additional funds and would struggle without further financial support.

By the end of 2021, just a third of small businesses in the sector were optimistic about future growth. The Hospitality and Leisure sector is emerging as the industry most crippled by Omicron: Christmas reservations were cancelled as the British public tried to protect themselves and their families.

After fresh calls for increased governmental support, the Chancellor announced a £1bn fund to help businesses hit by the rise in Covid-19 cases. Hospitality businesses will be able to apply for cash grants of up to £6,000 per premises. Following a challenging year, we can only hope this help is not too late for British businesses in the Hospitality and Leisure sector.

You can download the full Business Barometer Report 2022 here.