Economic volatility remains top worry as three quarters of small business owners kept awake at night

Monday 4th March 2024

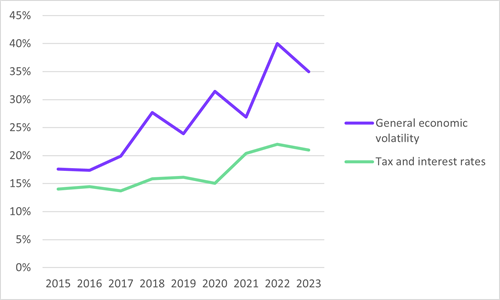

New data from Novuna Business Finance reveals that 75% of small business owners are experiencing sleepless nights, with market volatility being their top concern for the second consecutive year. With 35% expressing worry about this in Q1’24, the figure has slightly decreased from Q1’22's peak, amidst market turmoil following the then Government’s mini-budget, yet remains roughly double the level from eight years ago (18% in Q1 2015).

Despite inflationary rates remaining at 4% in February[1], the effects of rates peaking at 11.1% in the 18 months prior have continued to profoundly affect the outlook of small business owners. The data showed that, along with general economic volatility, the proportion of small business owners kept awake by concerns over interest rates particularly has significantly increased over the last eight years, rising from 16% to 21%. Again, this is broadly on a par with a year ago (22%).

Perhaps unsurprisingly, given these circumstances, the proportion of businesses struggling to manage their cash flow has increased in the last year, from 19% to 21%, making it one of the top three issues this year. Additionally, worries about retaining business remain high, with a very slight increase to 22% (up from 21% last year).

Sector-specific differences have revealed distinct challenges faced by businesses across industries. Construction and real estate businesses were the most concerned this quarter, with 84% and 87% respectively reporting major worries—the highest since records began in 2015. Both sectors have experienced an upward trend in anxiety levels among business leaders since 2022 (76% and 75% respectively in Q1’22).

Market volatility is a key issue for businesses in the hospitality (56%) and retail (61%) sectors. Additionally, within the hospitality sector, 44% of businesses express the most concern about interest rates.

Interestingly, while concerns about the impact of Brexit have dropped to their lowest recorded levels—falling to 12% from 26% four years ago— this issue still poses a significant worry for retail (30%) and IT (26%) sectors. Similarly, only 6% said they were still grappling with the long-term effects of COVID-19, a sharp decrease from 39% in 2021. However, in the hospitality and leisure sector, a notable 22% of businesses still cite this as a major issue.

Regionally, the research revealed a marked increase in anxiety over the last two years among businesses in Yorkshire and the Humber, increasing from 77% in 2022 to 82% now. This makes businesses in this region the most likely to have concerns compared to any other region. Similarly, there has been an uptick in the proportion of businesses kept awake in Wales over the last two years, rising from 72% to 78%.

Small business owners might be mildly relieved by the recent stabilisation of inflation rates, but it goes without saying that the long shadow cast by the previously high rates and market turmoil witnessed over the past 18 months has had a monumental effect on their outlook and operations. As the backbone of the economy, small business owners find themselves in a relentless battle against rising costs and unpredictable market conditions, making the task of forecasting and managing their financial futures for the long term nigh on impossible.

Leaders are crying out for a period of steadiness, predictability, and above all, certainty, Yet, with three-quarters of business leaders admitting to sleepless nights currently, it's clear they are not finding this stability. This data serves as a crucial reminder of the resilience and adaptability required from small businesses to navigate these tumultuous times. However, it also acts as a clarion call for leaders to engage with organisations like Novuna Business Finance, which can assist them in planning for the long term. Such collaboration can help businesses navigate economic volatility more effectively, positioning them not just to survive but to thrive amid challenges.

Jo Morris

Head of Insight

Novuna Business Finance

Additional tables

Businesses kept up at night by worries, by sector

|

|

Q1'15 |

Q1'16 |

Q1'18 |

Q1'19 |

Q1'20 |

Q1'21 |

Q1'22 |

Q1'23 |

Q1'24 |

|

Manufacturing |

74% |

77% |

71% |

78% |

79% |

79% |

80% |

91% |

72% |

|

Construction |

80% |

66% |

67% |

70% |

77% |

69% |

76% |

82% |

84% |

|

Retail |

67% |

62% |

75% |

82% |

72% |

83% |

75% |

91% |

74% |

|

Finance & Accounting |

75% |

74% |

76% |

81% |

78% |

83% |

78% |

76% |

82% |

|

Hospitality & Leisure |

77% |

65% |

71% |

81% |

70% |

85% |

81% |

79% |

84% |

|

Legal |

71% |

76% |

70% |

80% |

69% |

90% |

74% |

84% |

62% |

|

IT / Telecoms |

68% |

63% |

70% |

76% |

77% |

77% |

81% |

78% |

80% |

|

Media and marketing |

78% |

62% |

70% |

80% |

74% |

87% |

87% |

79% |

72% |

|

Medical and health |

68% |

73% |

71% |

71% |

69% |

75% |

63% |

73% |

66% |

|

Education |

63% |

68% |

63% |

76% |

68% |

72% |

81% |

62% |

75% |

|

Transport and distribution |

73% |

87% |

69% |

78% |

73% |

77% |

71% |

77% |

66% |

|

Real estate |

84% |

83% |

64% |

80% |

59% |

83% |

75% |

81% |

87% |

|

Other |

70% |

69% |

65% |

75% |

83% |

83% |

72% |

72% |

66% |

|

Agriculture |

64% |

88% |

77% |

74% |

81% |

79% |

85% |

79% |

75% |

Businesses kept up at night by worries, by region

|

|

Q1'16 |

Q1'18 |

Q1'19 |

Q1'20 |

Q1'21 |

Q1'22 |

Q1'23 |

Q1'24 |

|

North East |

87% |

75% |

74% |

79% |

80% |

76% |

80% |

73% |

|

North West |

67% |

71% |

74% |

70% |

76% |

75% |

82% |

74% |

|

Yorks/Humber |

69% |

75% |

69% |

65% |

78% |

77% |

85% |

82% |

|

East Mids |

64% |

78% |

80% |

82% |

81% |

81% |

80% |

71% |

|

West Mids |

66% |

57% |

74% |

76% |

75% |

78% |

80% |

71% |

|

East |

70% |

67% |

69% |

75% |

71% |

78% |

71% |

69% |

|

London |

77% |

73% |

87% |

86% |

87% |

83% |

80% |

79% |

|

South East |

67% |

69% |

76% |

69% |

81% |

69% |

78% |

77% |

|

South West |

68% |

69% |

78% |

71% |

78% |

78% |

76% |

67% |

|

Wales |

73% |

79% |

71% |

67% |

87% |

72% |

86% |

78% |

|

Scotland |

65% |

69% |

74% |

78% |

82% |

79% |

75% |

75% |

Notes

The research was conducted by YouGov among a representative sample of 1,124 small business decision makers, spanning all key industry sectors. The fieldwork was conducted between 5-19 January 2024.

[1] https://news.sky.com/story/uk-inflation-rate-remains-at-4-13071253