Growth outlook in transport and distribution sector continues to struggle after a difficult Q1

Monday 22nd May 2023

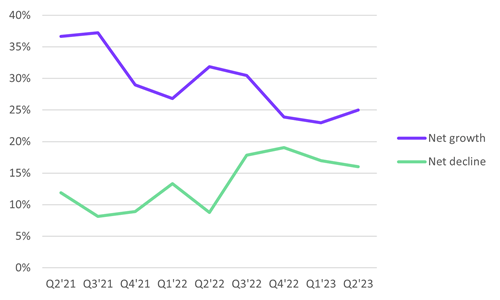

Growth outlook for small businesses in transport remains low, with only 25% of small businesses in the sector forecasting growth. This is compared with last quarter which saw projections fall to a three-year low (23%), continuing a downward trend seen since the start of 2021 – with little improvement this quarter, growth forecasts in transport continue to sit considerably lower than the national average (25% vs 32%).

The number of small firms contracting, however, has gradually decreased from its peak in Q4’22, where we saw the number of small businesses predicting contraction or closure reach its highest level since Q1’21 (25% vs 16% this quarter).

This comes at a time when further interest rate increases from the Bank of England could dampen the recovery of small business, while firms are also under pressure from high costs of energy, raw materials and rising staff wage bills.

Growth outlook among small businesses in transport and distribution

The Novuna Business Finance study has been tracking small business growth predictions against prevailing market conditions every quarter since 2015. At the start of each quarter Novuna asks a representative sample of 1,200 small business owners about their growth predictions for the next three months. At a time of unprecedented economic strain and market uncertainty, the growth projections indicate small signs of recovery from the sector, with the pronounced dip in those businesses contracting adding to the gradually improving outlook.

Across the country, the picture by sector told a varied story. Hospitality was not the only sector to bounce back, with signs of much-needed recovery for small businesses in Agriculture and Retail – two sectors hit especially hard during the Covid era. In the Agricultural sector, the percentage of small business owners predicting growth has risen from 22% to 30% over the last 12 months, with positive growth forecasts in retail up from 25% to 31%.

Whilst the percentage of small businesses predicting growth in Manufacturing (34%) and Construction (31%) remains largely flat over the 12-month period, growth forecasts have fallen sharply in the Media sector (from 49% to 38%). Further, with uncertainty over UK property prices, growth forecasts in the Real Estate and Property sector have fallen from 21% to 15% over the last 12-months.

A combination of high energy costs, an uncertain economic outlook and low consumer confidence is hampering the outlook for many in the transport sector. Nationally, the percentage of small business predicting growth has been remarkably steady at between 27%-30% for the last four quarters. Whilst this suggests resilience, the picture does vary considerably by industry sector - with our latest data also revealing that those small businesses who arguably had the hardest time over the past few years were also those more likely to be predicting growth as we move towards summer.

In the current economic climate, many enterprises are focusing on financial strength as the platform from which to plan business growth. For many, this involves managing late payment and protecting cash flow and many enterprises also see 2023 as a time to invest – in new equipment and capabilities. For established businesses looking to drive growth in 2023, Novuna Business Finance is committed to helping them fulfil their true potential. We understand the growth cycles that small businesses go through and we have both the products and toolkits to support their growth ambitions.

Jo Morris

Head of Insight

Novuna Business Finance

The research was conducted by YouGov among a representative sample of 1,088 small business decision makers between 27 March and 10 April 2023, spanning all key industry sectors.