Proportion of Welsh small businesses scaling back hits four-year low

Monday 26th June 2023

New research by Novuna Business Finance reveals positive growth forecasts for Welsh small businesses, with the proportion of growing businesses remaining stable, while those scaling back or struggling to survive declining significantly. The survey of over 1,000 small business leaders and senior decision makers found the proportion anticipating contraction this quarter hit its lowest level in almost four years (14% vs 13% Q3’19). This is over half the proportion of that six months ago (30% in Q4’22), and well below the average for the past five years (27%).

Forecasts for growth paint an equally positive picture, with more than a quarter of small enterprises in Wales predicting significant or modest expansion in the next three months (28%). This figure is double what it was this time last year (14% Q2’22) and sits just below the national average figure (32%).

Proportion of businesses anticipating growth/contraction in the next three months

Positive investment plans

To support this positive growth outlook, half of small businesses in Wales had plans to grow their businesses in the next 12 months which would require finance/borrowing money. At the top of the list, one in 10 said they had plans to invest in new vehicles (10%), or new machinery (9%). This was followed by campaigns to launch into new markets outside the UK (9%), moving to a bigger office location (8%), and increasing headcount within the business (7%).

However, at a time when gross lending to UK-based small and medium-sized enterprises (SMEs) by the main High Street banks declined 18% year-on-year in 2022[1], while the sector is already under pressure from proposed Prudential Regulation Authority (PRA) regulatory changes proposing to remove preferential treatment for SMEs[2], access to finance could become more of a challenge.

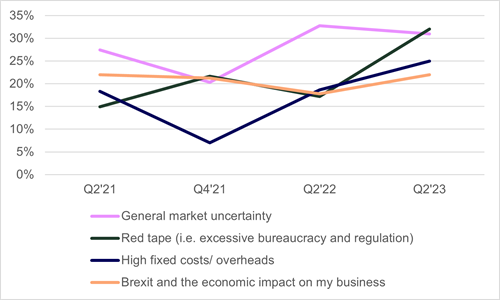

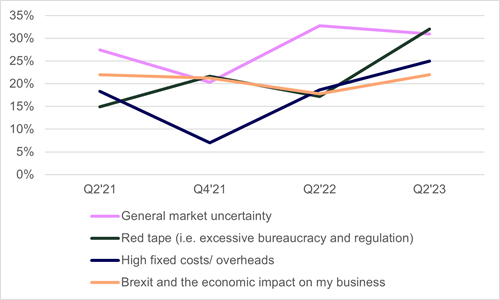

External barriers intensify

Despite confidence amongst Welsh small businesses when it came to growth, the research also revealed external barriers to growth were becoming more intense. Asking leaders about the barriers which were currently holding their businesses back from growing in the next three months, the three top issues were to do with regulations and red tape (32%), followed by increasing fixed costs (25%), and the economic impact of Brexit (22%).

In each case, the proportion of businesses who saw these as issues holding their businesses back had increased in the last two years

Signs of confidence are apparent in this quarter’s findings, with some stability in the proportion anticipating growth in the next three quarters, and a significant decline in the proportion scaling back. This is extremely welcome news, particularly after the considerable headwinds that have been faced by small businesses in the past five years. However, many of the issues that have plagued small businesses during this time have not gone away – from high fixed costs, economic uncertainty, and excessive red tape – which will continue to present challenges for leaders to contend with.

Access to finance is key for small businesses in their ability to enact their plans and retain confidence. This is becoming a growing issue that must be tackled. At Novuna Business Finance, our simple and competitive funding is designed to fit around the needs of small businesses, helping customers to buy or lease business assets. With an expert team and award-winning services, we can provide access to the finance solution our customers need, and are committed to helping them to develop and grow.

Jo Morris

Head of Insight

Novuna Business Finance

Barriers to growth for Welsh small businesses over five quarters

|

|

Q4'20 |

Q2'21 |

Q4'21 |

Q2'22 |

Q2'23 |

|

General market uncertainty |

35% |

27% |

20% |

33% |

31% |

|

The long term impact of Covid-19 on my business operations |

55% |

34% |

24% |

9% |

16% |

|

Brexit and the economic impact on my business |

30% |

27% |

21% |

18% |

22% |

|

Value of sterling/ exchange rates |

2% |

- |

3% |

3% |

9% |

|

Crime and theft |

- |

- |

- |

1% |

- |

|

Red tape (i.e. excessive bureaucracy and regulation) |

17% |

15% |

22% |

17% |

32% |

|

Cost of skilled labour |

7% |

10% |

14% |

18% |

18% |

|

Not having a cutting edge presence in the digital marketplace |

9% |

2% |

3% |

4% |

1% |

|

Not having the best technology for internal communications and file sharing |

4% |

- |

- |

4% |

- |

|

High fixed costs/ overheads |

3% |

18% |

7% |

19% |

25% |

|

Banks being restrictive on lending money |

11% |

11% |

8% |

3% |

5% |

|

Lack of understanding from lenders |

3% |

3% |

3% |

2% |

- |

|

High fees to pay (e.g. to the bank) |

3% |

4% |

8% |

7% |

2% |

|

Volatile cash flow |

17% |

20% |

12% |

7% |

10% |

|

Having old/ out-of-date equipment |

4% |

3% |

2% |

3% |

7% |

|

Unpredictable/ extreme weather |

5% |

- |

3% |

8% |

13% |

|

Uncertainty as to the future of my business's outlook/ prospects |

41% |

15% |

15% |

16% |

22% |

|

An unwillingness within the business to take risks |

3% |

3% |

4% |

10% |

2% |

|

Other |

13% |

13% |

16% |

10% |

20% |

|

Don't know |

- |

1% |

3% |

3% |

1% |

|

Not applicable - nothing currently holds my business back from growing |

9% |

17% |

15% |

21% |

14% |

Which areas Welsh small businesses need funding in order to further growth

|

|

Q4'20 |

Q2'21 |

Q4'21 |

Q2'22 |

Q4'22 |

Q2'23 |

|

Invest in new vehicles |

12% |

7% |

14% |

16% |

13% |

10% |

|

Invest in new production lines/ machinery |

13% |

10% |

9% |

17% |

9% |

9% |

|

Modernise IT capability/ purchase new IT equipment |

15% |

3% |

10% |

16% |

16% |

7% |

|

Invest in a new company brand/ website |

11% |

10% |

6% |

14% |

9% |

3% |

|

Launch new products/ services |

13% |

13% |

12% |

12% |

9% |

5% |

|

Run a marketing/ advertising campaign |

14% |

9% |

15% |

9% |

10% |

8% |

|

Launch into new markets outside the UK |

11% |

11% |

8% |

6% |

7% |

9% |

|

Launch into new market segments within the UK |

12% |

6% |

11% |

6% |

6% |

3% |

|

Increase headcount/ hire new people |

9% |

14% |

15% |

18% |

10% |

7% |

|

Move to a better location/ bigger space |

7% |

7% |

11% |

8% |

11% |

8% |

|

Fully adapt the business to new data protection laws (i.e. put compliance systems in place) |

4% |

3% |

1% |

4% |

6% |

3% |

|

Pitch for major accounts/ compete with larger competitors |

9% |

1% |

9% |

13% |

7% |

3% |

|

Invest in staff training programmes |

6% |

5% |

6% |

14% |

5% |

6% |

|

Pay suppliers on time |

4% |

13% |

12% |

5% |

5% |

8% |

|

Pay our tax bills |

9% |

9% |

5% |

9% |

6% |

6% |

|

Not applicable - there is nothing we would not be able to do |

37% |

40% |

48% |

38% |

44% |

51% |

The research was conducted by YouGov among a representative sample of 1,088 small business decision makers between 27 March and 10 April 2023, spanning all key industry sectors.

[1] UK Finance (6 June 2023) https://www.thebanker.com/Banker-Data/Banker-Database/Lending-to-UK-SMEs-declines-as-economy-slows