Scottish small businesses lead UK in growth outlook

Friday 22nd September 2023

- Scottish small businesses are the most optimistic about growth in the UK, with 35% anticipating expansion in the next quarter

- Amid economic challenges, 71% working on specific initiatives to secure business growth

- Technology continues to be a pivotal factor for businesses, with 71% leveraging it for benefits like competitive pricing and reduced overheads

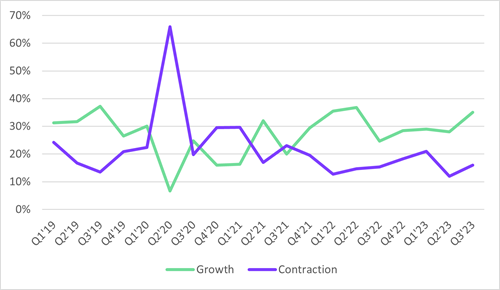

Small businesses in Scotland are among the most likely to predict growth of any region in the UK this quarter, according to new research from Novuna Business Finance. A notable 35% of Scottish businesses anticipate growth in the coming months, outpacing their counterparts in Wales (27%) and England (32%). This is the highest figure in five quarters and is similar to levels seen pre-pandemic.

Additionally, the rate of Scottish businesses expecting a downturn is relatively low. Only 16% foresee either moderate or severe contraction in the next three months. These figures are lower than those from Wales (19%) and England (17%), as well as the three-year average of 19% since the onset of the pandemic.

Efforts small businesses are undertaking to ensure growth this summer

A significant 71% of small businesses are currently implementing targeted initiatives to drive growth, a noticeable increase from last year's 65% and the highest figure in two years. Amid challenges such as the cost-of-living crisis, rising inflation, and consecutive interest rate increases, small business leaders are focusing on cost management as a means to set their enterprises on a growth trajectory. Around two-thirds (67%) cited reducing fixed costs as their top priority, followed by enhancing cash flow (30%) and more rigorously pursuing overdue payments (18%).

In terms of investment, there has been a marked uptick in businesses planning to acquire new equipment, almost doubling from 12% a year ago to 23% now. The data also revealed a substantial rise in businesses relocating to larger premises, up from 9% to 14%. Hiring staff also saw a boost, climbing from 16% last year to 20% currently. In terms of funding, the proportion of businesses looking for financial backing through a partner or company rose from 9% last year to 15% currently. Meanwhile, 11% said they were re-evaluating their financial commitments (flat on a year ago).

The prospect of securing growth by expanding overseas into new markets remained low at 11%. This is a stark contrast to the more robust figures of 2016 and 2017, where the rate hovered between 25% and 28%, suggesting that the aftermath of Brexit has had a disruptive impact on many Scottish small businesses' global aspirations.

Increasing dependence on technology among businesses

Over the past two years, the role of technology in business has become increasingly critical, with the proportion of businesses maximizing the benefits of technology to deliver a faster and better service increasing. While the proportion of businesses that said they have been positively impacted by the use of technology in the last two years has remained constant at 71%, there was a substantial uptick in businesses stating it has allowed them to be more competitive in pricing (from 11% in 2021 to 25% now), or helped to cut overhead costs (from 20% to 28%). The main advantages highlighted were enhanced time management (35%) and the ability to offer faster services (33%).

Our tracking research highlights the resilience and adaptability of Scottish small businesses, even in the face of economic challenges. These findings offer a clue about what might be next. If business owners are working on future growth initiatives now, we should see an uplift in the overall proportion of businesses reporting growth during the autumn and winter months.

We also note from the research that, beyond cost control, many enterprises are looking to invest in new equipment and to review their funding relationships. At Novuna Business Finance, we are a specialist alternative to high street banks for small businesses — and we are committed to supporting established enterprises that are working on strategies to adapt, grow, and fulfill their potential despite the enormously challenging context.

Jo Morris

Head of Insight

Novuna Business Finance

Additional tables:

Proportion of Scottish Businesses predicting Growth/Contraction (2019-present)

Strategies businesses are considering for achieving growth in Q3 2023

|

|

UK average |

Scottish Businesses |

|

Improving cash flow |

30% |

30% |

|

Being stricter with getting paid on time (e.g. from clients) |

26% |

18% |

|

Keeping fixed costs down |

58% |

67% |

|

Securing financing to replace a vital business asset(s) |

4% |

2% |

|

Investing in new equipment |

18% |

23% |

|

Streamlining supply chain |

7% |

10% |

|

Seeking financial funding via a partner/ company other than our bank |

6% |

15% |

|

Moving to a different location/ bigger office |

6% |

14% |

|

Expanding into new markets/ overseas |

17% |

11% |

|

Reassessing finance commitments |

12% |

11% |

|

Hiring more people |

21% |

20% |

Impact of technology on Scottish small businesses in the past year

|

|

2021 |

2023 |

|

Better enables us to compete on price |

11% |

25% |

|

Ability to provide a faster service |

32% |

33% |

|

Safer storage of sensitive information |

25% |

14% |

|

Our use of data for marketing has become more effective |

20% |

7% |

|

Reduces staff costs |

18% |

11% |

|

Reduces office overheads |

20% |

28% |

|

Reduces the cost of doing new business |

22% |

24% |

|

Drives a need for new skills and training |

11% |

25% |

|

Opens up new markets |

18% |

20% |

|

Drives greater productivity |

25% |

28% |

|

Makes us more environmentally friendly |

27% |

28% |

|

Helps staff with remote working |

46% |

30% |

|

Cuts down travel time - to work/meetings |

36% |

35% |

|

Spend less time in meetings |

22% |

23% |

|

Other |

13% |

3% |

Note to editors

The research was conducted by YouGov among a representative sample of 1,103 small business decision makers between 19 June and 2 July 2023, spanning all key industry sectors.