Economic volatility worries increase as three quarters of Scottish small business owners kept awake at night

Thursday 21st March 2024

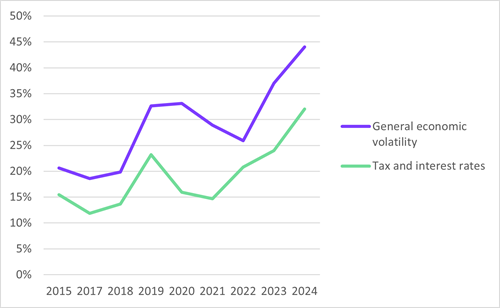

New data from Novuna Business Finance reveals that 75% of Scottish small business owners are experiencing sleepless nights, with market volatility remaining their top concern for the second consecutive year. The proportion of businesses expressing worry about this reached 44% in Q1 2024, almost double the proportion from two years ago (26%) and far exceeding the UK average of 35% this quarter.

Despite the latest forecast from the Office for Budget Responsibility (OBR) suggesting that inflation is set to fall below 2% in the next few months[1], the effects of rates peaking at 11.1% over the previous 18 months have continued to affect the outlook of small business owners. The data showed that, along with general economic volatility, the proportion of small business owners kept awake by concerns over interest rates has peaked this year, rising from 24% last year to 32% this year. Again, this figure is significantly higher than that of the rest of the UK (21%).

Scottish businesses kept awake by economic volatility, and tax and interest rates

Perhaps unsurprisingly, given these circumstances, the proportion of businesses struggling to manage their cash flow has risen in the last year from 15% to 23%, making it one of the top three concerns this year.

Additionally, Scottish small business owners were also more likely than their counterparts in other parts of the UK to be kept awake by worries over the impact of Brexit on their business (19% vs. a 12% UK average), recruiting staff (15% vs. a 9% UK average), and the effects of unpredictable or extreme weather (15% vs. a 6% UK average).

Confidence levels among Scottish businesses remain robust this quarter, with 31% indicating they anticipate either modest or significant growth in the coming three months. This marks an improvement from last quarter (23% in Q4 2023), though it is slightly behind the UK average of 33%. Mirroring this trend, the proportion of businesses anticipating a decline has slightly decreased to 15% (down from 17% last quarter).

“Small business owners in Scotland might be mildly relieved by the recent stabilisation of inflation rates, but it goes without saying that the long shadow cast by the previously high rates and market turmoil witnessed over the past 18 months has had a monumental effect on their outlook and operations. As the backbone of the economy, small business owners find themselves in a relentless battle against rising costs and unpredictable market conditions, making the task of forecasting and managing their financial futures for the long term nigh on impossible.

“Leaders are crying out for a period of steadiness, predictability, and above all, certainty, Yet, with three-quarters of business leaders admitting to sleepless nights currently, it's clear they are not finding this stability. This data serves as a crucial reminder of the resilience and adaptability required from small businesses to navigate these tumultuous times. However, it also acts as a clarion call for leaders to engage with organisations like Novuna Business Finance, which can assist them in planning for the long term. Such collaboration can help businesses navigate economic volatility more effectively, positioning them not just to survive but to thrive amid challenges.”

Jo Morris

Head of Insight

Novuna Business Finance

Additional tables

Issues keeping small business owners awake at night, UK vs Scotland comparison

UK average | Scotland | Difference | |

Compliance and Regulations | 17% | 15% | -2% |

Red tape (i.e. excessive bureaucracy and regulation) | 15% | 17% | 2% |

Managing cash flow | 21% | 23% | 2% |

Bad debts | 8% | 8% | 0% |

Considering better finance options | 3% | 4% | 1% |

Recruitment | 9% | 15% | 6% |

Borrowing and lending | 5% | 5% | 0% |

Business rates | 10% | 11% | 1% |

Employee skill gaps and shortages | 11% | 8% | -3% |

Retaining business | 22% | 19% | -3% |

Tax and interest rates | 21% | 32% | 11% |

General economic volatility | 35% | 44% | 9% |

The effects of unpredictable/ extreme weather | 9% | 15% | 6% |

The impact of Brexit on my business | 12% | 19% | 7% |

The current public health impact of Covid on my business (i.e. restrictions and social distancing rules and government advise for people to work from home) | 4% | 6% | 2% |

The longer term economic impact of Covid on my business | 6% | 10% | 4% |

Other | 4% | 4% | 0% |

Don't know | 1% | 1% | 0% |

Issues keeping Scottish small business owners awake at night, comparison over time

Q1'15 | Q1'16 | Q1'18 | Q1'19 | Q1'20 | Q1'21 | Q1'22 | Q1'23 | Q1'24 | |

Compliance and Regulations | 20% | 15% | 20% | 20% | 28% | 19% | 19% | 12% | 15% |

Red tape (i.e. excessive bureaucracy and regulation) | 20% | 19% | 25% | 21% | 25% | 18% | 18% | 18% | 17% |

Managing cash flow | 18% | 16% | 17% | 13% | 27% | 22% | 19% | 15% | 23% |

Bad debts | 7% | 3% | 3% | 1% | 12% | 8% | 7% | 5% | 8% |

Considering better finance options | 1% | 4% | 3% | 2% | 6% | 2% | 3% | 0% | 4% |

Recruitment | 6% | 7% | 7% | 10% | 15% | 6% | 15% | 14% | 15% |

Borrowing and lending | 5% | 1% | 4% | 1% | 4% | 3% | 5% | 5% | 5% |

Business rates | 8% | 3% | 8% | 7% | 8% | 6% | 11% | 11% | 11% |

Employee skill gaps and shortages | 9% | 9% | 11% | 15% | 14% | 6% | 12% | 14% | 8% |

Retaining business | 21% | 19% | 20% | 16% | 27% | 21% | 24% | 25% | 19% |

Tax and interest rates | 15% | 12% | 14% | 23% | 16% | 15% | 21% | 24% | 32% |

General economic volatility | 21% | 19% | 20% | 33% | 33% | 29% | 26% | 37% | 44% |

The effects of unpredictable/ extreme weather | 10% | 20% | 19% | 13% | 17% | 13% | 11% | 10% | 15% |

The impact of Brexit on my business | N/A | N/A | N/A | N/A | 35% | 25% | 26% | 20% | 19% |

The current public health impact of Covid on my business (i.e. restrictions and social distancing rules and government advise for people to work from home) | N/A | N/A | N/A | N/A | N/A | 34% | 23% | 7% | 6% |

The longer term economic impact of Covid on my business | N/A | N/A | N/A | N/A | N/A | 40% | 26% | 12% | 10% |

Other | 8% | 5% | 13% | 11% | 3% | 8% | 6% | 12% | 4% |

Don't know | 2% | - | - | 1% | - | 1% | 1% | 3% | 1% |

Not applicable – Nothing about my business is currently keeping me awake at night | 33% | 35% | 31% | 26% | 22% | 18% | 21% | 25% | 25% |

Notes

The research was conducted by YouGov among a representative sample of 1,124 small business decision makers, spanning all key industry sectors. The fieldwork was conducted between 5-19 January 2024.

[1] https://www.moneymarketing.co.uk/news/inflation-set-to-fall-below-2-in-next-few-months/