Cautious MPC as inflation proves sticky

We've teamed up with Pantheon Macroeconomics, a premier provider of unbiased, independent macroeconomic research to bring you a summary of the UK economic outlook.

- The market is pricing no more rate cuts this year, after the MPC switched its focus to elevated inflation

- Rate-setters see less chance of a sharp job fall as forward-looking labour-market indicators stabilise

- Tax hikes are unlikely to fall directly on businesses, but two months of rumours can hit sentiment

Rate cut hopes fade as sticky inflation keeps the MPC cautious

The MPC left Bank Rate unchanged at 4.00% in September, as the consensus and markets expected, with seven members of the Committee voting to keep rates on hold, and two members—Swati Dhingra and Alan Taylor—voting to reduce Bank Rate by 25bp.

Rate-setters subtly shifted their guidance to signal a lower chance of further rate cuts this year.

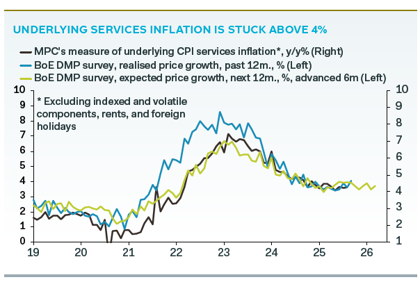

The MPC said it was focused more on household inflation expectations looking elevated—which could feed back into stronger wage growth and prolong the time inflation spends above the 2% target—than weak employment. The Committee said “upside risks around medium-term inflation pressures remained prominent”.

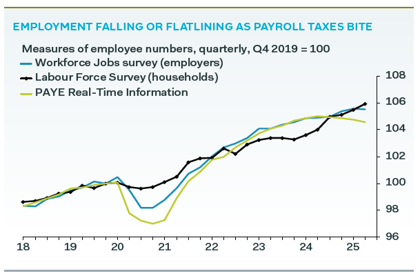

By contrast, rate-setters judged that downside risks to the labour market had eased. That might seem odd in light of payrolls falling for seven consecutive months. But other employment indicators are less weak, as our chart below left shows, and a range of indicators suggest that the job market is stabilising. For instance, Google Trends searches for “redundancy” fell to a nine-month low in September, and job vacancies stabilised in August.

Surveys point to high inflation persisting, however. The Bank of England’s survey of around 2,000 CFOs—the Decision Maker Panel—shows underlying services inflation stuck above 4% for 18 months now, as our chart above shows. GDP growth also beat expectations in the first half of the year and is holding up in Q3, according to the PMI. So, the market has moved to pricing our long-held call that the MPC would cut rates only three times in 2025 and will keep

rates on hold for the rest of the year.

A big event is looming on the horizon in the form of the November 26 Budget, which will likely see tax hikes of around £25B per year, most likely phased in slowly over five years. The Chancellor’s £10B of headroom against her fiscal rules has been scorched by policy U-turns on welfare cuts, higher debt interest costs and likely growth forecast downgrades. We doubt tax hikes will fall on businesses again; the Chancellor will be wary of repeating that mistake. But two more months of tax rumours could sap sentiment.