Recourse & non-recourse factoring

-

Cash flow challenge: I need to release cash from unpaid invoices - but I’m not sure who takes on the risk.

-

Perfect for: Businesses looking to improve cash flow by factoring invoices, but need clarity

on the trade-off between cost and protection.

You can unlock fast access to unpaid revenue where this page helps you understand the difference between recourse and non-recourse factoring and how Novuna can help you find the right facility.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1977 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Our invoice finance options

Pages in this SectionWhat is recourse and non-recourse factoring?

When you factor an invoice, the finance provider advances you a large percentage of the invoice value upfront. But what happens if your customer fails to pay?

That’s where the difference between recourse and non-recourse factoring comes in:

- Recourse factoring: Your business is ultimately liable if the customer doesn’t pay. This option is usually cheaper, but risk stays with you.

- Non-recourse factoring: The finance provider takes on the risk of non-payment. It typically costs more, but gives you protection against bad debt.

How it works with Novuna Business Cash Flow

- Tell us your funding challenge - complete a short form or call

- We compare providers and recommend a great fit for your situation

- You apply with full support from a cash flow expert

- Access funding fast often within 24-72 hours

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is recourse or non-recourse factoring right for you?

Choose recourse factoring if:

You want the most cost-effective facility

Recourse factoring typically comes with lower fees since you’re retaining the risk of non-payment.

You’re confident in your customers payment reliability

It works best if your customers have a strong track record of paying on time.

You’re prepared to take on the risk if a customer defaults

If an invoice goes unpaid, you’re responsible for repaying the advance to the lender.

Choose non-recourse factoring if:

You want protection against bad debt

Non-recourse factoring includes credit protection, so you’re not liable if a customer doesn’t pay due to insolvency.

Your business can’t absorb the cost of non-payment

You can delay outflows while suppliers still get paid promptly, helping you manage working capital more effectively.

You trade with customers that have inconsistent payment histories

Non-recourse factoring offers peace of mind when dealing with higher risk or unpredictable buyers.

Not sure which is best? We’ll guide you through the options based on your cash flow, customer base, and risk profile.

Novuna can support businesses with a range of funding challenges

I want to release cash from my unpaid invoices

I want a confidential facility with full ledger control

I want to manage which invoices I finance

I want a one-off facility to free up cash quickly

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

Access a range of short-term funding options including loans, advances, and invoice finance.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Don’t let unpaid invoices hold your business back

Why choose Novuna Business Cash Flow?

Why businesses trust us with their invoice finance needs

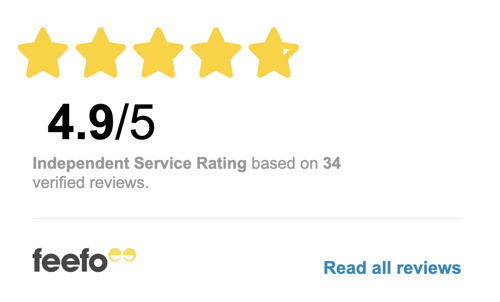

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What factoring looks like in your sector

Get advice tailored to the challenges in your industry

What is the difference between recourse and non-recourse factoring?

Recourse factoring means your business remains responsible if a customer doesn’t pay their invoice. In contrast, non-recourse factoring includes bad debt protection, where the factoring provider absorbs the loss if a debtor becomes insolvent or unable to pay.

How does recourse factoring work?

With recourse factoring, you sell your invoices to a finance provider and receive an advance (usually up to 90%). If a customer fails to pay within an agreed period, your business must buy back or replace the unpaid invoice. It’s cheaper but carries higher risk.

How does non-recourse factoring work?

In non-recourse factoring, the provider assumes the credit risk for approved debtors. You receive cash upfront for your invoices, and if a customer defaults due to insolvency, the lender takes the loss protecting your business from bad debt exposure.

Which type of factoring is better for UK businesses?

It depends on your business risk appetite and customer reliability. Recourse factoring offers lower fees but more responsibility whereas Non-recourse factoring provides greater peace of mind but higher costs.