Revenue based finance

-

Cash flow challenge: I want funding that flexes with the ups and downs of my revenue.

-

Perfect for: High-growth or seasonal businesses like ecommerce brands, subscription services, and agencies with variable monthly income.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1982 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Our seasonal funding options

Pages in this SectionWhat is revenue based finance?

Revenue based finance is a flexible funding solution that allows UK businesses to access capital in exchange for a fixed percentage of future revenue. Instead of fixed monthly repayments, repayments fluctuate in line with turnover, making it particularly suitable for businesses with recurring or variable income.

Unlike traditional loans, revenue based finance adjusts with performance where you repay more when revenue is strong and less when revenue slows. There is no equity dilution, and in many cases, no requirement for property security.

Example of revenue based finance in practice

If a business receives £150,000 with a 1.4x repayment cap, the total repayment would be £210,000.

If the agreed revenue share is 8%:

- In a month generating £100,000 revenue, repayment would be £8,000

- In a slower month generating £60,000 revenue, repayment would be £4,800

If revenue grows quickly, the facility may be repaid within 10–14 months. If revenue slows, repayment naturally extends but the total repayment remains capped at £210,000.

Benefits of revenue based finance

- Flexible repayments – Payments rise and fall in line with your revenue.

- No equity dilution – Retain full ownership of your business.

- Fast access to capital – Funding decisions based on revenue performance.

- No fixed monthly instalments – Avoid rigid loan-style repayments.

- Ends once repaid – No long-term debt once the cap is reached.

How it works with Novuna Business Cash flow

-

Tell us about your revenue profile and funding needs

-

We compare providers and recommend a great deal for your situation

-

You apply with full support from a cash flow expert

-

Access the funds and repay flexibly as your revenue grows

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is revenue based finance right for you?

You want funding that grows with your business

Prepayments are tied to your revenue, so the amount you repay adjusts with your business performance.

You don’t want rigid repayment terms

There’s no fixed monthly amount, giving you flexibility to repay more when you earn more and less when you don’t.

You want to protect your cash flow during slower months

Payments automatically reduce when income dips, helping you manage cash flow in quieter periods.

If that sounds like your business, we’ll help you compare providers and get funded fast.

Novuna can support businesses with a range of seasonal funding challenges

I want to spread supplier costs and ease cash flow pressures

I need extended terms or supplier credit for seasonal purchases

My revenue fluctuates

I need short-term capital to prepare for peak periods

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right type of funding

Access a range of short-term funding options including loans, advances, and invoice finance.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Don’t let a cash flow drop stop your business

Why choose Novuna Business Cash Flow?

Why businesses trust us for fast funding

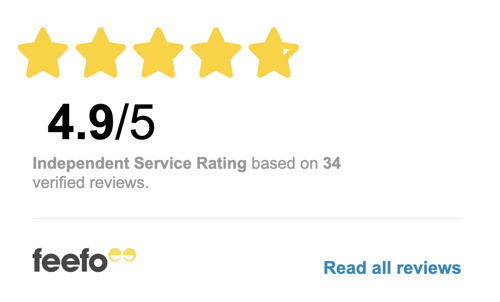

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What funding looks like in your sector

Get advice tailored to the challenges in your industry

How does revenue based finance work in the UK?

You receive an upfront cash advance based on your company’s recurring or projected revenue. The lender is repaid automatically through a share of your daily or monthly sales, until the agreed amount plus a flat fee is paid back.

Who can qualify for revenue based finance?

RBF suits UK businesses with steady, predictable income such as eCommerce, SaaS, and subscription-based companies. Lenders typically require at least six months of trading data and a consistent revenue track record.

How is revenue based finance different from a business loan?

Unlike a bank loan with fixed instalments and interest, revenue based finance repayments rise and fall with your income. There’s no fixed term, and funding decisions are made using your real-time business performance rather than credit score alone.