Facing the barriers and managing the opportunities

For seven years, we have tracked barriers to growth every 6 to 12 months and explored what businesses are working on to secure growth. This chapter looks at the opportunities and persistent threats as well as fleeting menaces.

In alternating quarters, we asked businesses the same two questions. Firstly, we asked decision-makers about the growth of their company in the next three months and what factors they identified as inhibiting business growth.

Secondly, we asked what businesses were considering doing to try and achieve business growth in the next six months, looking both at the ways they are investing in the business for growth, and the measures taken to control their finances.

We have been able to track how viewpoints and priorities have changed over seven years, as more businesses have responded to different challenges. Assessing the data in its entirety, we can now also see longer term trends among small businesses.

Bruising period has changed business owners’ perception of barriers to growth

In the first chapter, we saw overall robustness and resilience among small businesses in the face of adversity. In this chapter we see that repeated setbacks have had a visible impact on small businesses’ outlook.

The pandemic and events leading up to it—from Brexit referendum, subsequent General Elections, and the worst recession in memory—have created a rollercoaster ride of uncertainty.

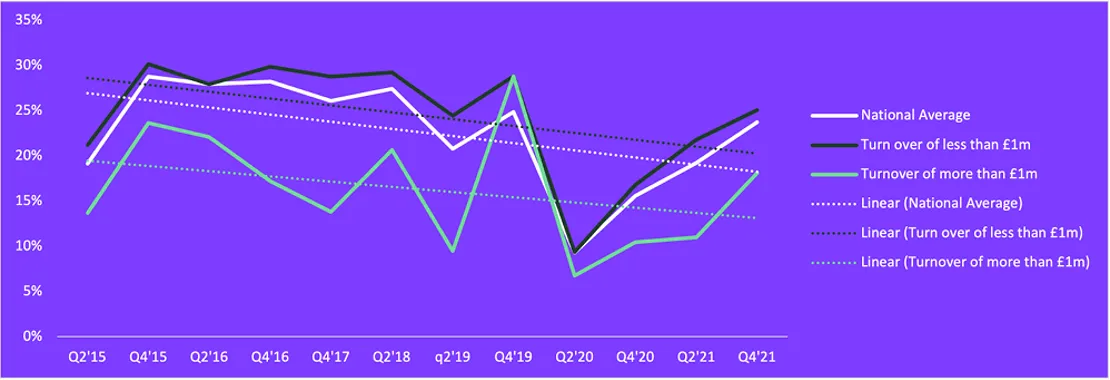

The research clearly indicates that the cumulative impact of these various events has affected owners’ perception of barriers to business growth and has made those owners more cautious. While there have been peaks and troughs in the proportion of businesses that believed there were no direct inhibitors to growth, this proportion has dwindled over the past seven years. In 2015, around 30% believed there were no barriers to their growth; today, that figure is closer to 20%.

The drop is more pronounced in smaller businesses. Among companies with a turnover of less than £1 million, the proportion dropped by 10% (from 29% in 2015 to 19% today). Meanwhile, for enterprises with a turnover of more than £1 million, the drop was approximately 5% (from 20% to around 15%).

Key barriers to growth:

Market uncertainty: Since 2015, the chief priority for business growth plans has been keeping fixed costs down. The proportion prioritising this has stayed around 55% consistently, rising to 61% at the start of 2021.

Cash flows: Accessing cash and managing volatile cash flow has been a primary concern for small businesses, peaking during the pandemic and as the recession bit (around one in five small businesses said this inhibited their growth in Q2 2020). Similarly, anxiety about banks’ restricting loans has consistently featured in the list of concerns. This also peaked during the height of the recession, following the same pattern as cash flow.

Red tape: Reassessing finance commitments has had the biggest proportional rise (+7% on average), peaking in Q3 2020 as the recession took hold.

Brexit: When the UK formally withdrew from the European Union in January 2021, Brexit and the economic impact on individual businesses was a barrier to growth for around one in five (21%) businesses. For businesses with a turnover of more than £1 million, concerns about Brexit peaked later in Q2 2021 at 29%, falling away to 26% by the end of the year.

Cost of labour: Following the CBI warning, in October 2021, that the UK is facing two years of labour shortages, concerns about the cost of labour have risen among business owners. In Q4 2021, the proportion saying that this was limiting their growth rose to 11%—the highest since Q2 2019. This was most keenly felt among businesses with a turnover of more than £1 million.

Overheads: With remote and hybrid working becoming mainstream during the pandemic, attention turned to fixed costs and overheads. The proportion that said this was an inhibiting factor for their business rose from 7% in Q4 2020 to 11% in Q4 2021. Smaller businesses felt this most acutely. Fifteen per cent of businesses with a turnover of less than £1 million pointed to their overhead as an inhibiting factor (the proportion rising for three consecutive quarters), compared to 9% of larger businesses.

Plans to power growth – and the appetite for risk

Set against the backdrop of seven years of caution and rising concern around barriers to growth, there has been an appreciable change in small businesses’ appetite for risk.

In Quarters 1 and 3 every year since 2015 we have asked small businesses about their plans to achieve growth in the coming quarter. The questions have focused on active investment plans and cost control measures. Together, these give us a sense of the risk levels that small business owners are comfortable with, and the actions they are taking which demonstrate this.

Slight decrease in active investment

Hiring:

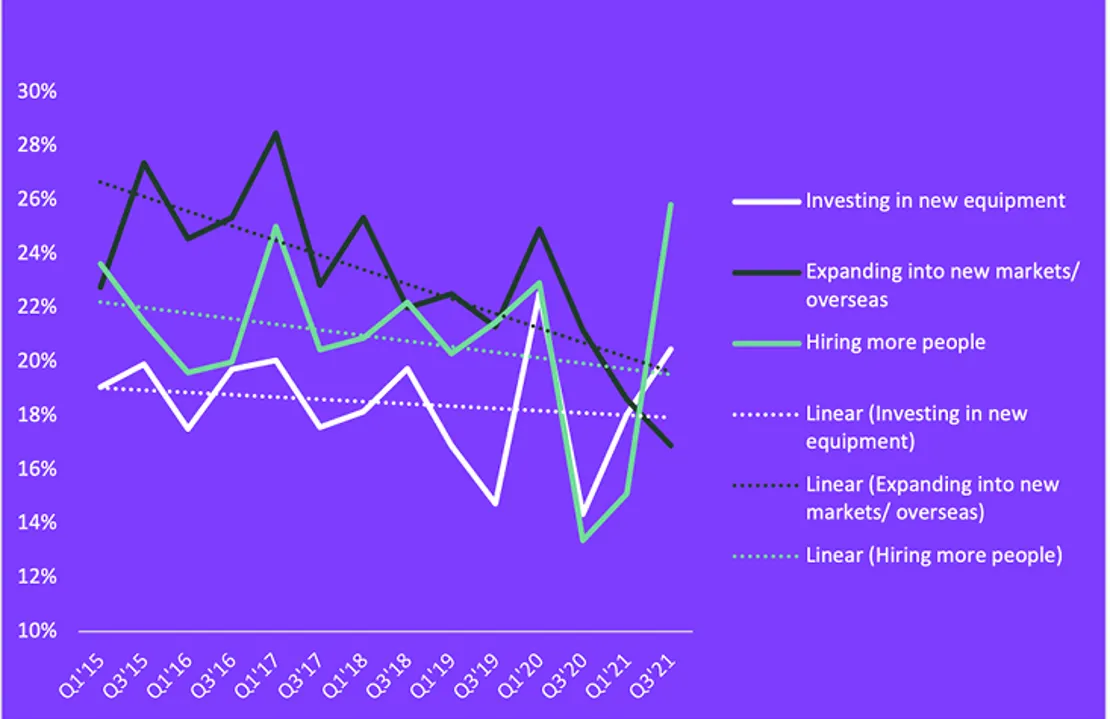

While the proportion of businesses actively hiring reached its highest figure on records in Q3 21 (26%), the trend across the past seven years has seen a gradual decline from 23% in 2015 to an average of around 19% today.

Expanding into new markets overseas:

There is a dramatic decline here, with an average fall of around 7% over seven years. The impact of Brexit is clear—from around 27% of small businesses intending to expand into new markets overseas pre-referendum to 17% in Q3 2021.

Investing in new equipment:

The proportion of small businesses actively investing in new equipment has remained consistent. In 2015, around 19% were investing in new equipment for their business. Despite striking dips in Q3 2019 (15%) and Q3 2020 (13%), it has returned to 20% (Q3 2021).

Purse strings gradually tightening

As active spending measures decreased, the results showed that cost control measures either increased or stayed the same.

Fixed costs:

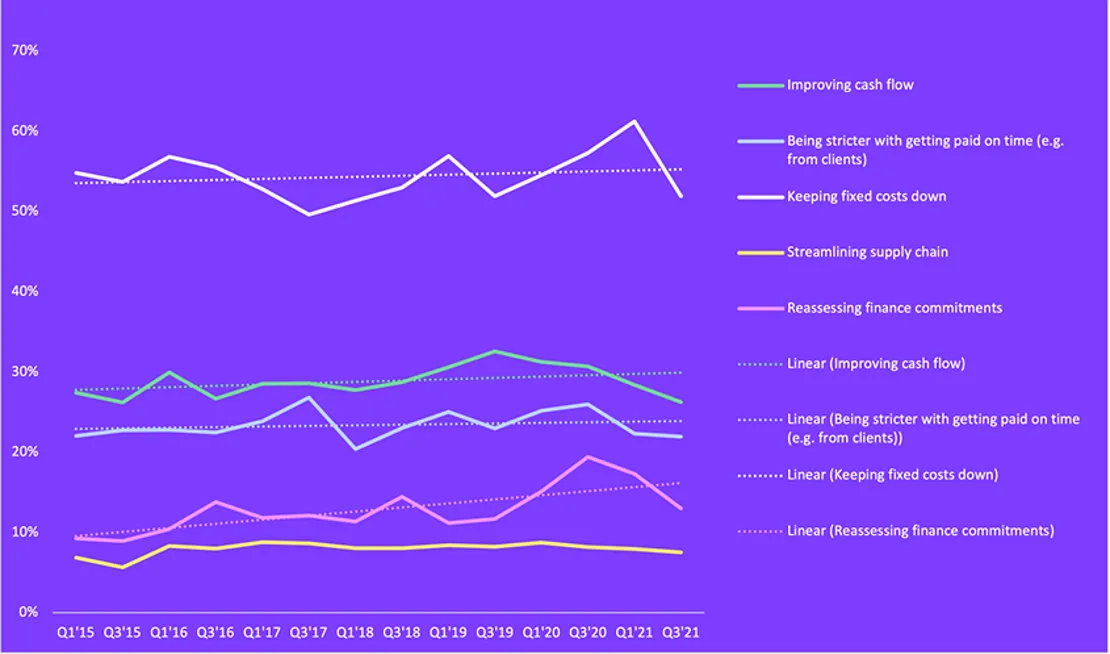

Since 2015, the chief priority for business growth plans has been keeping fixed costs down. The proportion prioritising this has stayed around 55% consistently, rising to 61% at the start of 2021.

Cash flow and getting strict with clients:

Improving cash flow and insisting that invoices are paid on time are increasingly important to small businesses. The proportion of businesses prioritising these has increased by around 5 per cent.

Reassessing finance commitments:

Reassessing finance commitments has had the biggest proportional rise (+7% on average), peaking in Q3 2020 as the recession took hold.

Concluding remarks

“Whilst chapter one presented a picture of resilience from small business owners, maintaining a strong growth outlook despite a challenging context, this chapter shows how hard it has been for many to adapt and respond to unforeseen market shocks. Barriers to growth have been a serious cause of concern and investment strategies for growth have often had to be measured and pragmatic.

The issues in this chapter underline how hard small businesses have had to work to maintain a positive outlook, and it underlines the financial support many will in 2022 as they rebuild and plan for growth after Covid restrictions.”

Geoff Maleham, Managing Director, Novuna Business Finance

You can download the full Business Barometer Report 2022 here.