Study shows shoppers spend up to 166% more using finance

Written by

Wednesday 17th September 2025

Last updated: 25th September 2025

As we head into the Golden Quarter, the busiest shopping period of the year, new insights from Novuna Consumer Finance reveal just how much difference point-of-sale finance can make to customer spending habits. The findings show it’s not only about budgeting convenience, but also about unlocking significantly higher order values and driving retail growth.

Shoppers spend more when flexible payment options are available

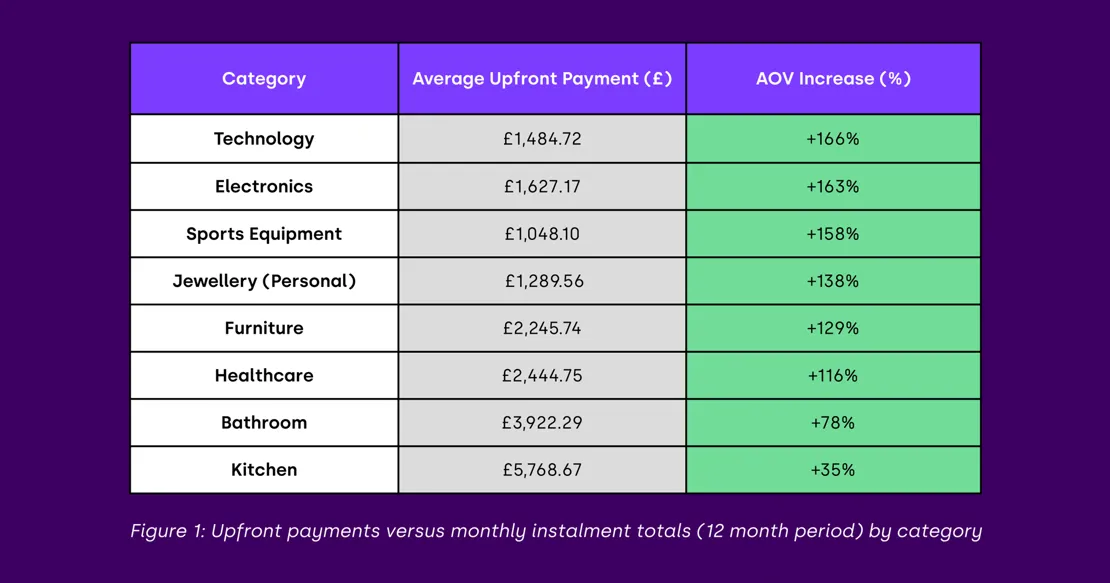

The research shows that when given the choice to spread the cost in monthly instalments, UK consumers are willing to invest more in big-ticket items. By multiplying the average monthly payment by 12 to reflect a full year of instalments, the data reveals a sharp uplift in average order values (AOVs) across every retail category - in some cases by more than 150%.

Highlights include:

- Technology: upfront spend of £1,485 rises to £3,944 when calculated as 12 monthly instalments (+166%)

- Electronics: £1,627 upfront compared to £4,275 via 12 instalments (+163%)

- Sporting equipment: £1,048 upfront versus £2,707 over 12 instalments (+158%)

- Jewellery (personal use): £1,290 upfront compared to £3,068 when paid in 12 instalments (+138%)

This demonstrates that when upfront cost barriers are removed, customers are not only more likely to buy but are also prepared to choose higher-value products.

Take a look at our sector-by-sector breakdown below, which shows just how much retailers can boost their average order value by offering finance.

Why point-of-sale finance matters for retailers

For retailers, the findings highlight a crucial shift: finance is no longer simply a payment option, but a proven sales accelerator. By offering finance throughout the buying journey, retailers can increase conversion rates, encourage higher-value purchases, and stand out in a highly competitive marketplace.

During the Golden Quarter, when retailers are competing for attention, offering responsible finance solutions could be the difference between securing a customer or losing them to a competitor.

Gender-based spending trends retailers can tap into

The study also highlights gender differences in customer spending habits. Men are more likely to increase spending on electronics, where finance lifts average spend from £2,228 upfront to £6,219 (+179%).

For women, the biggest increase is seen in sporting goods, where spend rises from £550 to £1,496 with finance (+172%).

For retailers, these insights underline the value of tailoring finance messaging by category and demographic to unlock further sales growth.

Finance appetite across generations

Demand for point-of-sale finance spans all age groups, proving its broad relevance. Younger shoppers, often closely associated with the boom in the buy now pay later (BNPL) payment solution, show dramatic increases across the board with 25 to 34-year-olds more than tripling their technology spend (+202%), and 16 to 24s nearly tripling their electronics spend (+195%).

However, even older shoppers demonstrate a strong appetite for flexible payment options. In fact, the over-55s recorded the single largest uplift across all groups: a 241% increase in sports equipment spending, from £293 upfront to £999 with finance.

What this means for retailers

The findings underline the strategic value of finance for retailers during the Golden Quarter and beyond. By offering flexible, responsible finance solutions at the point of sale, retailers can directly influence how much customers are prepared to spend on big-ticket items.

The research shows that finance options encourage customers to treat themselves and unlock higher order values across categories. With multiple retailers competing for consumer attention, the ability to offer flexible payment choices could make all the difference.

Looking beyond seasonal peaks, finance isn’t just about driving immediate sales. It also builds stronger customer relationships by making the shopping experience more accessible, flexible and rewarding.

“Finance isn’t just a payment method, it’s a sales accelerator. In a crowded market, offering finance at the point of sale is no longer just a ‘nice to have’ - it can be the difference between winning and losing a customer.”

"Looking beyond seasonal peaks, finance isn’t just about driving immediate sales. It also builds stronger customer relationships by making the shopping experience more accessible, flexible and rewarding."

“It’s not just about boosting sales today, but about creating a better experience that keeps customers coming back.”

Brian Flesk

Head of Retail

Novuna Consumer Finance

Key takeaway for retailers

By offering retail finance solutions and flexible payment options at checkout and throughout the buying journey, retailers can significantly increase average order values, appeal to all demographics, and strengthen customer loyalty. As the Golden Quarter approaches, point-of-sale finance is an essential tool for retailers who want to maximise growth.

Written by

Anna Stacey is a skilled content writer based in Lincolnshire, specialising in the financial services industry. With over four years of experience in the digital landscape, she has an aptitude for crafting informative and engaging content that addresses a range of retailer needs. Spanning diverse topics, from finance and lending to broader digital marketing trends, Anna is committed to delivering customer-centric content that not only educates but also empowers readers to make informed decisions.