Finance Lease

-

Cash flow challenge: I want to use essential equipment without owning it outright.

-

Perfect for: Businesses needing flexibility, lower upfront costs, and full use of assets without long-term ownership.

A finance lease lets you use the asset your business needs from vehicles to machinery while spreading the cost through fixed monthly payments. You don’t own the asset, but you keep it for the agreed term and may be able to extend, upgrade or buy it later.

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Call us on 020 4632 1977 to speak to a real cash flow expert. We’ll help you apply for the right type of finance and make sure you get a great deal for your business.

Or click 'Boost your cash flow' below to compare providers.

Our asset finance options

Pages in this SectionWhat is finance lease?

A finance lease allows your business to access an asset over an agreed period without buying it outright. You’ll pay fixed monthly rentals, have full use of the asset, and may be able to extend the lease or purchase it at the end.

It’s a great option for businesses needing equipment now but wanting flexibility later.

How it works with Novuna Business Cash flow

-

Tell us what asset you need to lease

-

We compare providers and recommend a great fit for your situation

-

You apply with expert support

-

Start using the equipment while spreading the cost

Fast decisions. Flexible options. Funding over £2bn to more than 1,000 SMEs every year.

Is a finance lease right for you?

You want to use the asset now, without buying it upfront

Finance leases give you immediate access to equipment while spreading the cost over time.

You prefer fixed monthly payments for budgeting certainty

Predictable payments help with cash flow planning and financial stability.

You may want the option to extend or purchase later

At the end of the lease, you can often choose to continue leasing, return the asset, or buy it outright.

If that sounds like your situation, we’ll help you compare lease options and get the right structure in place.

Novuna can support a range of asset funding needs

I want to buy the asset outright over time

I want to lease with return options at end of term

I need to finance specific tools, tech or kit

I need business vehicles without high upfront costs

How we help

How Novuna helps businesses access funding fast

Tell us what you need

Start with a simple form or call - tell us your business challenge.

We compare your options

We compare multiple providers to get you a great deal.

Choose the right asset finance

We help you decide whether finance lease, operating lease or hire purchase is best for your goals.

Apply with expert support

Get help applying - with a real expert on hand throughout.

Get clear, transparent terms

No jargon, no surprises – just honest advice with no hidden fees.

Receive funding fast

Get access to finance quickly so you can focus on your business.

Why take action now

Get the equipment you need without cash flow stress

Why choose Novuna Business Cash Flow?

Why businesses trust us for leasing and asset finance

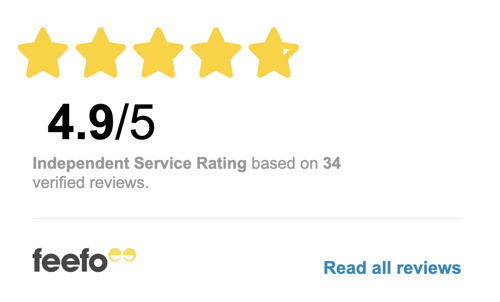

We're highly rated by our existing customers

"The communication and support has been outstanding. Providing me with all the information I needed regarding new clients coming onto our books. The system they use is so user friendly and the drawdown payments are very efficient in the fast moving world of temporary payroll.'

More reviewsWe're a multi-award winning business cash flow specialist

What finance leasing looks like in your sector

Tailored solutions for your industry

What are the benefits of a finance lease?

- Access to high-value assets without large upfront costs

-

Fixed monthly payments for easier budgeting

-

Potential tax advantages, as lease payments are often deductible

-

Flexible end-of-term options, including secondary rentals or sale participation

What happens at the end of a finance lease?

- Return the asset to the lender

-

Sell the asset on behalf of the lender and receive a share of the proceeds

-

Extend the lease for a small secondary rental fee (“peppercorn rental”)

What’s the difference between a finance lease and an operating lease?

A finance lease transfers most of the risks and rewards of ownership to the lessee, while an operating lease is more like a rental, where you use the asset temporarily and return it at the end of the contract with no ownership or sale rights.